Question: 02 6. Break-Even EBIT and Leverage. Cooke Co. is comparing two different capital structures. Plan I would result in 8,500 shares of stock and $361,000

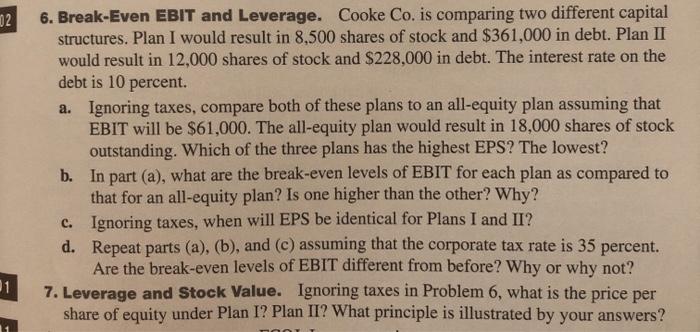

02 6. Break-Even EBIT and Leverage. Cooke Co. is comparing two different capital structures. Plan I would result in 8,500 shares of stock and $361,000 in debt. Plan II would result in 12,000 shares of stock and $228,000 in debt. The interest rate on the debt is 10 percent. a. Ignoring taxes, compare both of these plans to an all-equity plan assuming that EBIT will be $61,000. The all-equity plan would result in 18,000 shares of stock outstanding. Which of the three plans has the highest EPS? The lowest? b. In part (a), what are the break-even levels of EBIT for each plan as compared to that for an all-equity plan? Is one higher than the other? Why? c. Ignoring taxes, when will EPS be identical for Plans I and II? d. Repeat parts (a), (b), and (c) assuming that the corporate tax rate is 35 percent. Are the break-even levels of EBIT different from before? Why or why not? 7. Leverage and Stock Value. Ignoring taxes in Problem 6, what is the price per share of equity under Plan I? Plan II? What principle is illustrated by your answers? 02 6. Break-Even EBIT and Leverage. Cooke Co. is comparing two different capital structures. Plan I would result in 8,500 shares of stock and $361,000 in debt. Plan II would result in 12,000 shares of stock and $228,000 in debt. The interest rate on the debt is 10 percent. a. Ignoring taxes, compare both of these plans to an all-equity plan assuming that EBIT will be $61,000. The all-equity plan would result in 18,000 shares of stock outstanding. Which of the three plans has the highest EPS? The lowest? b. In part (a), what are the break-even levels of EBIT for each plan as compared to that for an all-equity plan? Is one higher than the other? Why? c. Ignoring taxes, when will EPS be identical for Plans I and II? d. Repeat parts (a), (b), and (c) assuming that the corporate tax rate is 35 percent. Are the break-even levels of EBIT different from before? Why or why not? 7. Leverage and Stock Value. Ignoring taxes in Problem 6, what is the price per share of equity under Plan I? Plan II? What principle is illustrated by your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts