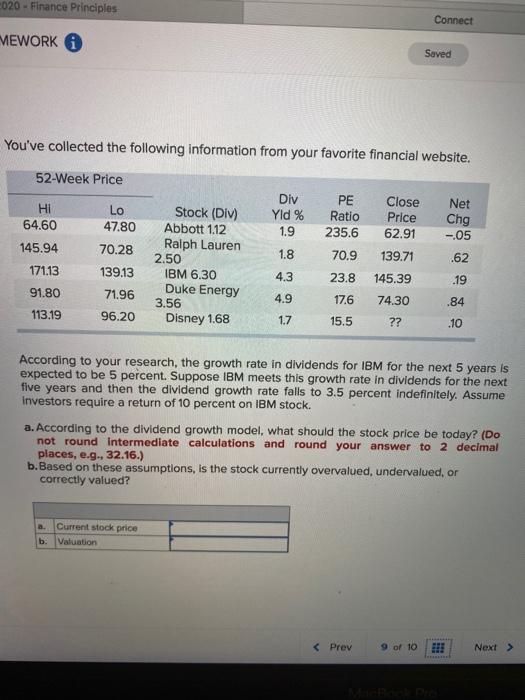

Question: 020 - Finance Principles Connect MEWORK A Saved You've collected the following information from your favorite financial website. 52-Week Price 64.60 LO 47.80 Div Yld

020 - Finance Principles Connect MEWORK A Saved You've collected the following information from your favorite financial website. 52-Week Price 64.60 LO 47.80 Div Yld % 1.9 PE Ratio 235.6 Close Price 62.91 Net Chg -05 145.94 70.28 1.8 70.9 139.71 .62 171.13 Stock (DIV) Abbott 1.12 Ralph Lauren 2.50 IBM 6.30 Duke Energy 3.56 Disney 1.68 139.13 4.3 23.8 145.39 .19 91.80 71.96 4.9 17.6 74.30 .84 113.19 96.20 1.7 15.5 ?? .10 According to your research, the growth rate in dividends for IBM for the next 5 years is expected to be 5 percent. Suppose IBM meets this growth rate in dividends for the next five years and then the dividend growth rate falls to 3.5 percent indefinitely. Assume investors require a return of 10 percent on IBM stock. a. According to the dividend growth model, what should the stock price be today? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Based on these assumptions, is the stock currently overvalued, undervalued, or correctly valued? a. Current stock price b. Valuation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts