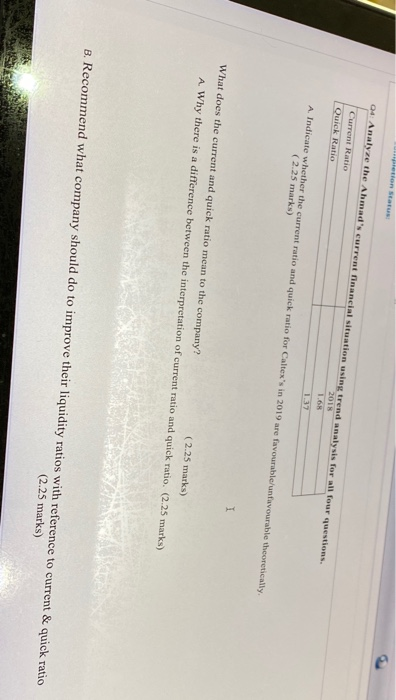

Question: 04: Analyze the Ahmad's current financial situation using trend analysis for all four questions. Current Ratio Quick Ratio A. Indicate whether the current ratio and

04: Analyze the Ahmad's current financial situation using trend analysis for all four questions. Current Ratio Quick Ratio A. Indicate whether the current ratio and quick ratio for Caltex's in 2019 are favourable/unfavourable theoretically, (2.25 marks) 1:37 I What does the current and quick ratio mean to the company? (2.25 marks) A Why there is a difference between the interpretation of current ratio and quick ratio. (2.25 marks) B. Recommend what company should do to improve their liquidity ratios with reference to current & quick ratio (2.25 marks) HILI 04: Analyze the Ahmad's current financial situation using trend analysis for all four questions. Current Ratio 2013 1.68 Quick Ratio 1.37 A Indicate whether the current ratio and quick ratio for Caltex's in 2019 are favourable/unfavourable theoretically, (2.25 marks) What does the current and quick ratio mean to the company? (2.25 marks) A Why there is a difference between the interpretation of current ratio and quick ratio. (2.25 marks) I B. Recommend what company should do to improve their liquidity ratios with reference to current & quick ratio (2.25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts