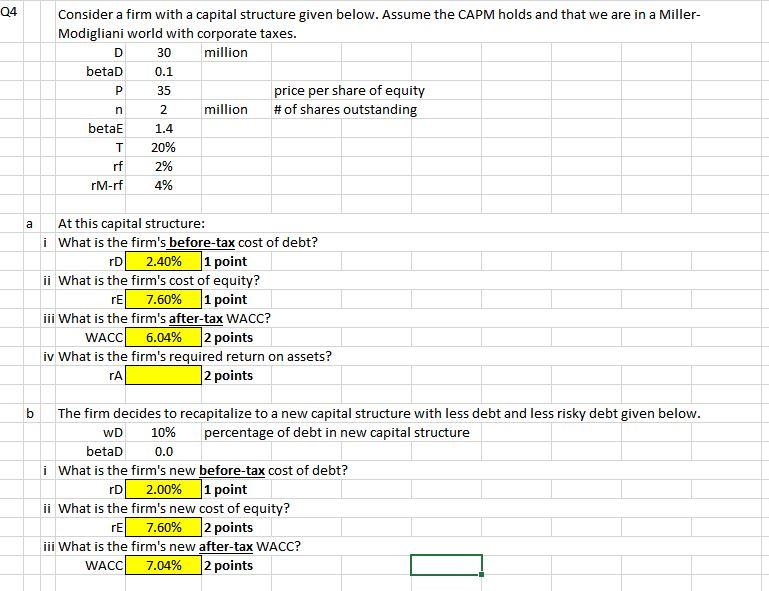

Question: 04 P Consider a firm with a capital structure given below. Assume the CAPM holds and that we are in a Miller- Modigliani world with

04 P Consider a firm with a capital structure given below. Assume the CAPM holds and that we are in a Miller- Modigliani world with corporate taxes. D 30 million betaD 0.1 35 price per share of equity 2 million # of shares outstanding betaE 1.4 T 20% rf 2% rM-rf 4% n a At this capital structure: i What is the firm's before-tax cost of debt? D 2.40% 1 point ii What is the firm's cost of equity? re 7.60% 1 point iii What is the firm's after-tax WACC? WACC 6.04% 2 points iv What is the firm's required return on assets? rA 2 points b WD The firm decides to recapitalize to a new capital structure with less debt and less risky debt given below. 10% percentage of debt in new capital structure betaD 0.0 i What is the firm's new before-tax cost of debt? D 2.00% 1 point ii What is the firm's new cost of equity? re 7.60% 2 points iii What is the firm's new after-tax WACC? WACC 7.04% 2 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts