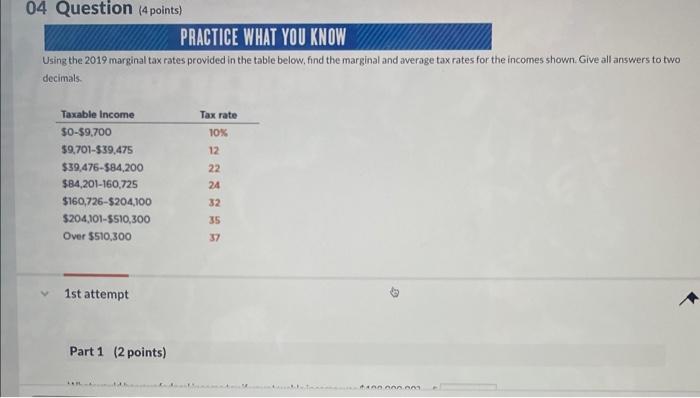

Question: 04 Question (4 points) PRACTICE WHAT YOU KNOW Using the 2019 marginal tax rates provided in the table below,find the marginal and average tax rates

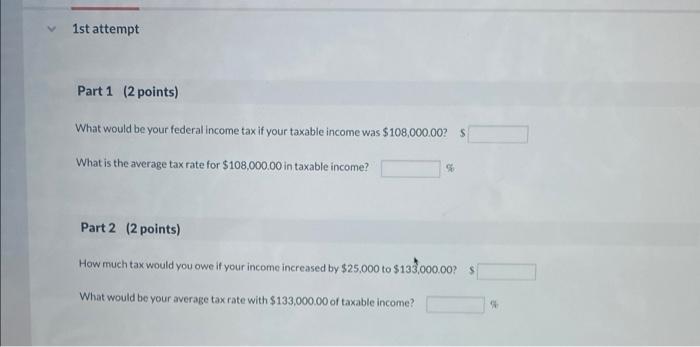

04 Question (4 points) PRACTICE WHAT YOU KNOW Using the 2019 marginal tax rates provided in the table below,find the marginal and average tax rates for the incomes shown. Give all answers to two decimals Taxable income $0-$9,700 $9,701-$39,475 $39,476-584,200 $84,201-160,725 $160,726-3204,100 $204,101-5510,300 Over $510,300 Tax rate 10% 12 22 24 32 35 37 1st attempt Part 1 (2 points) AAAAANAA 1st attempt Part 1 (2 points) What would be your federal income tax it your taxable income was $108,000.00 $ What is the average tax rate for $108,000.00 in taxable income? Part 2 (2 points) How much tax would you owe it your income increased by $25,000 to $133,000.00? What would be your average tax rate with $133,000.00 of taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts