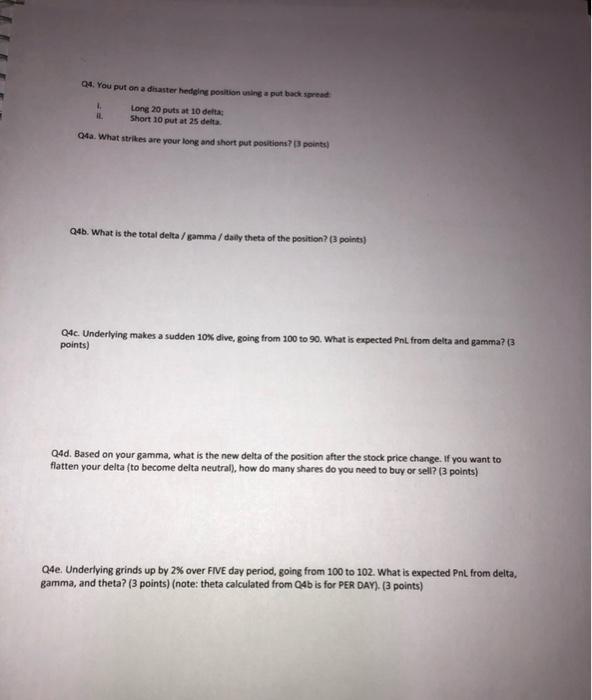

Question: 04. You put on a diaster hedeine positioning put back spread Long 20 puts at 10 delta Short 10 put at 25 delta. Ola. What

04. You put on a diaster hedeine positioning put back spread Long 20 puts at 10 delta Short 10 put at 25 delta. Ola. What strikes are your long and short put positions? 3 points Qub. What is the total delta / gamma/daily theta of the position?(3 points) 04c. Underlying makes a sudden 10% dive, going from 200 to 90. What is expected Pnt from delta and gamma? (3 points) Q4d. Based on your gamma, what is the new delta of the position after the stock price change. If you want to flatten your delta (to become delta neutral), how do many shares do you need to buy or sell? (3 points) Que Underlying grinds up by 2% over FIVE day period, going from 100 to 102. What is expected Pnl from delta, gamma, and theta? (3 points) (note: theta calculated from 04b is for PER DAY) (3 points) 04. You put on a diaster hedeine positioning put back spread Long 20 puts at 10 delta Short 10 put at 25 delta. Ola. What strikes are your long and short put positions? 3 points Qub. What is the total delta / gamma/daily theta of the position?(3 points) 04c. Underlying makes a sudden 10% dive, going from 200 to 90. What is expected Pnt from delta and gamma? (3 points) Q4d. Based on your gamma, what is the new delta of the position after the stock price change. If you want to flatten your delta (to become delta neutral), how do many shares do you need to buy or sell? (3 points) Que Underlying grinds up by 2% over FIVE day period, going from 100 to 102. What is expected Pnl from delta, gamma, and theta? (3 points) (note: theta calculated from 04b is for PER DAY) (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts