Question: 04.04-PR005 WP Reconsider Problem 04.02-PR019 (repeated here). Quantum Logistics, Inc., a wholesale distributor, is considering the construction of a new warehouse to serve the southeastern

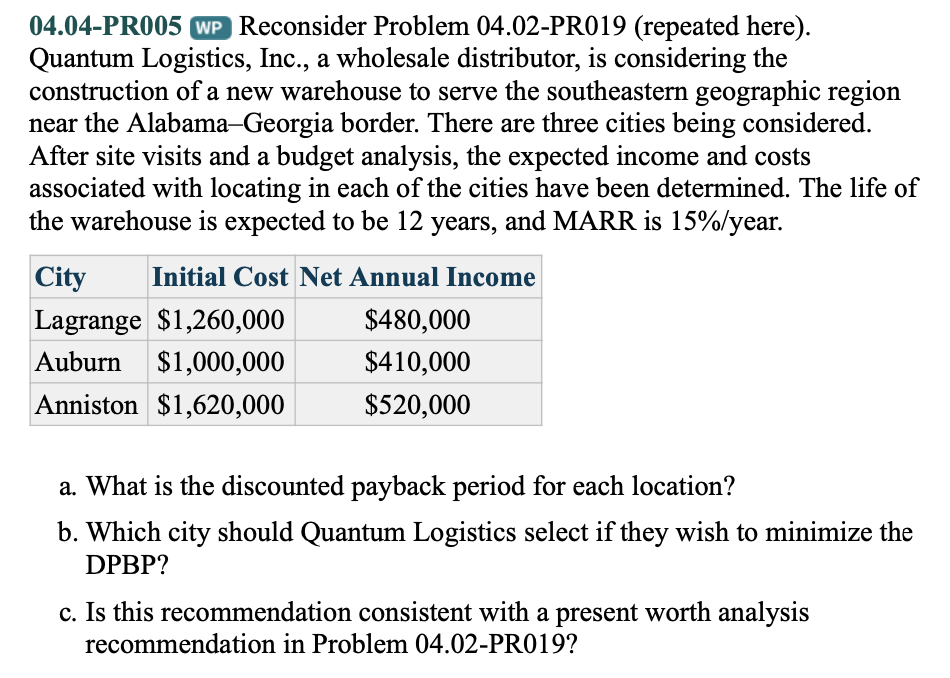

04.04-PR005 WP Reconsider Problem 04.02-PR019 (repeated here). Quantum Logistics, Inc., a wholesale distributor, is considering the construction of a new warehouse to serve the southeastern geographic region near the AlabamaGeorgia border. There are three cities being considered. After site visits and a budget analysis, the expected income and costs associated with locating in each of the cities have been determined. The life of the warehouse is expected to be 12 years, and MARR is 15%/year. City Initial Cost Net Annual Income Lagrange $1,260,000 $480,000 Auburn $1,000,000 $410,000 Anniston $1,620,000 $520,000 a. What is the discounted payback period for each location? b. Which city should Quantum Logistics select if they wish to minimize the DPBP? c. Is this recommendation consistent with a present worth analysis recommendation in Problem 04.02-PR019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts