Question: 05: Assignment - Time Value of Money Back to Assignment Attempts: Average: 14 13. Mortgage payments Mortgages, loans taken to purchase a property involve regular

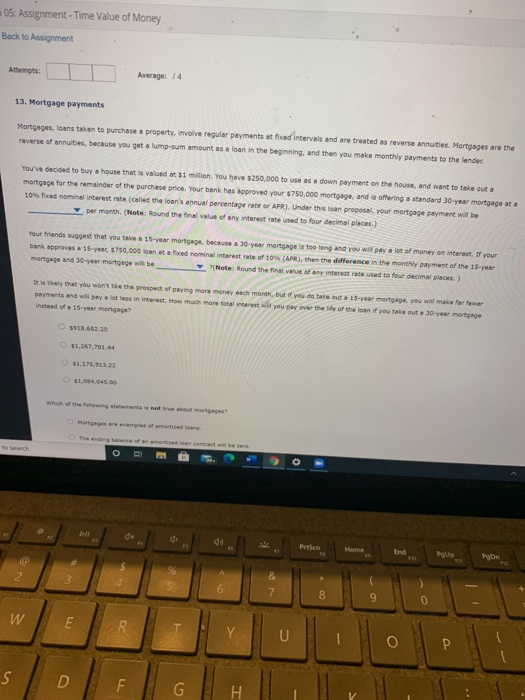

05: Assignment - Time Value of Money Back to Assignment Attempts: Average: 14 13. Mortgage payments Mortgages, loans taken to purchase a property involve regular payments at fred intervals and are treated as reverse annuities Mortgages are the reverse of annuites, because you get a lump sum amount as a loan in the beginning, and then you make monthly payments to the lender You've decided to buy a house that is valued at $1 million. You have $250,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. Your bank has approved your $750,000 mortgage, and is offering a standard 30-year mortgage at 10% fed nominal Interest rate (called the loan's annual percentage rate or APR). Under this loan proposal your mortgage payment will be per month (Note: Round the final value of any interest rate used to four decimal places.) Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your bank approves a 15-year, 5750,000 loan at a fod nominal interest rate of 10 (APR), then the difference in the monthly payment of the 15-year mortgage and 30-year mortgage will be Note: Round the final value of any interest rate used to four decimal places) It is likely that you won't like the prospect of paying more money each month, but you do take out a 15-year mortgage you will make for fewer payments and will pay a lot less interest. How much more to rest you say over the ocean if you take out a 30-year mortgage Instead of a 15-yer mortgage $1,267,7144 51,014.045.00 Which of the following tement is not trobar The edge of motion contre to search DI du Prem Home End Poup 6 7 8 9 W E R Y U O s D F G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts