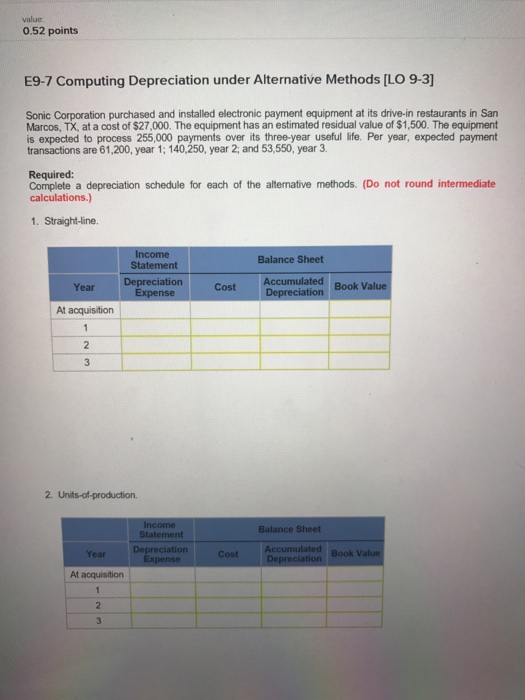

Question: 0.52 points E9-7 computing Depreciation under Alternative Methods [LO 9-31 Sonic Corporation purchased and installed electronic payment equipment at its drive-in restaurants in San Marcos,

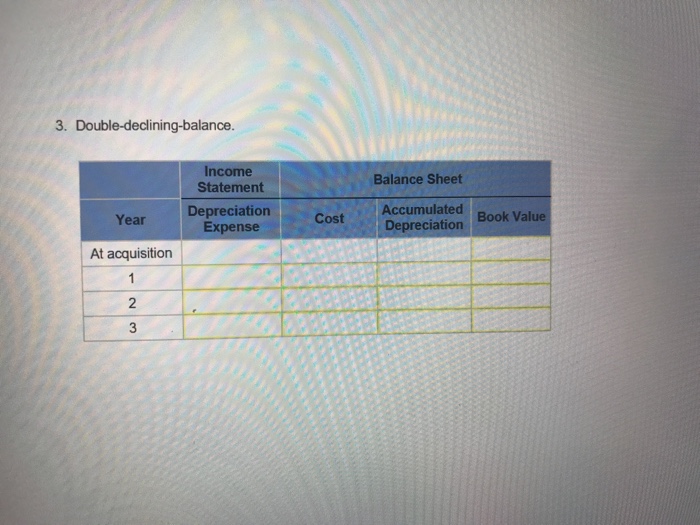

0.52 points E9-7 computing Depreciation under Alternative Methods [LO 9-31 Sonic Corporation purchased and installed electronic payment equipment at its drive-in restaurants in San Marcos, TX, ata cost of $27.000. The equipment has an estimated residual value of $1,500. The equipment is expected to process 255,000 payments over its three-year useful life. Per year, expected payment transactions are 61,200, year 1: 140,250, year 2; and 53,550, year Required: Complete a depreciation schedule for each of the alternative methods. (Do not round intermediate calculations.) 1. Straight-line. Balance Sheet Statement Accumulated Book Valu Depreciation Year Cost Depreciation Expense acquisition 2. Units of production. Balance Sheet Statement Cost Accumulated Book Value Depreciation At acquisition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts