Question: 07. 20 points in total Consider two bonds, Bond A and Bond B. both of which have face value $1,000, five years to maturity, and

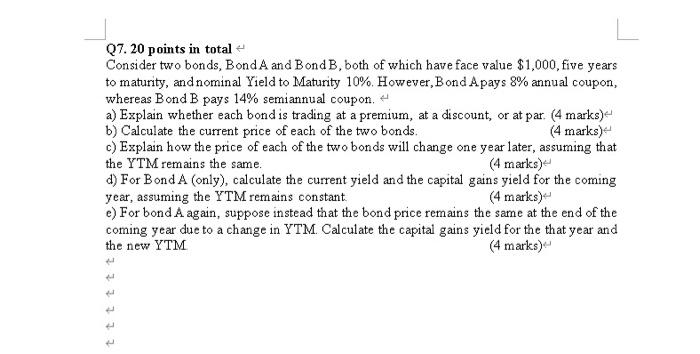

07. 20 points in total Consider two bonds, Bond A and Bond B. both of which have face value $1,000, five years to maturity, and nominal Yield to Maturity 10%. However, Bond Apays 8% annual coupon, whereas Bond B pays 14% semiannual coupon a) Explain whether each bond is trading at a premium, at a discount, or at par. (4 marks) b) Calculate the current price of each of the two bonds. (4 marks) c) Explain how the price of each of the two bonds will change one year later, assuming that the YTM remains the same. (4 marks) d) For Bond A (only), calculate the current yield and the capital gains yield for the coming year, assuming the YTM remains constant (4 marks) e) For bond A again, suppose instead that the bond price remains the same at the end of the coming year due to a change in YTM. Calculate the capital gains yield for the that year and the new YTM (4 marks) ttttt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts