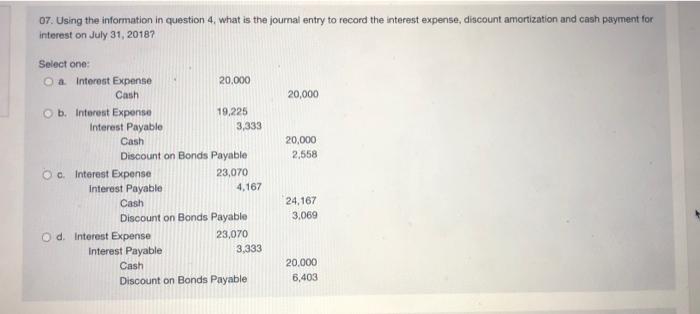

Question: 07. Using the information in question 4 what is the journal entry to record the interest expense, discount amortization and cash payment for interest on

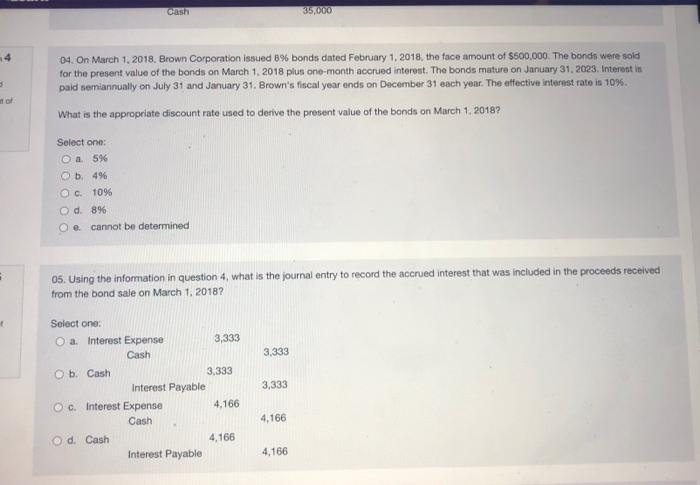

07. Using the information in question 4 what is the journal entry to record the interest expense, discount amortization and cash payment for interest on July 31, 20187 Select one: a interest Expense 20,000 Cash 20,000 b. Interest Expense 19,225 Interest Payable 3,333 Cash 20,000 Discount on Bonds Payable 2,558 OG Interest Expense 23,070 Interest Payable 4,167 Cash 24.167 Discount on Bonds Payable 3,069 Od. Interest Expense 23,070 Interest Payable 3,333 Cash 20.000 Discount on Bonds Payable 6,403 Casa 35,000 04. On March 1. 2018. Brown Corporation issued 8% bonds dated February 1, 2018, the face amount of $500,000. The bonds were sold for the present value of the bonds on March 1, 2018 plus one-month accrued interest. The bonds mature on January 31, 2023. Interest in paid semiannually on July 31 and January 31, Brown's fiscal year ends on December 31 each year. The effective interest rate in 10%. What is the appropriate discount rate used to derive the present value of the bands on March 1, 2018? Select one: O a 5% b. 49 C. 10% od 8% e cannot be determined 05. Using the information in question 4, what is the journal entry to record the accrued interest that was included in the proceeds received from the bond sale on March 1, 2018? + 3,333 3,333 Select one: O a. Interest Expense 3,333 Cash Ob. Cash 3,333 Interest Payable OC. Interest Expense 4.166 Cash Od. Cash 4.166 Interest Payable 4,166 4,166 07. Using the information in question 4 what is the journal entry to record the interest expense, discount amortization and cash payment for interest on July 31, 20187 Select one: a interest Expense 20,000 Cash 20,000 b. Interest Expense 19,225 Interest Payable 3,333 Cash 20,000 Discount on Bonds Payable 2,558 OG Interest Expense 23,070 Interest Payable 4,167 Cash 24.167 Discount on Bonds Payable 3,069 Od. Interest Expense 23,070 Interest Payable 3,333 Cash 20.000 Discount on Bonds Payable 6,403 Casa 35,000 04. On March 1. 2018. Brown Corporation issued 8% bonds dated February 1, 2018, the face amount of $500,000. The bonds were sold for the present value of the bonds on March 1, 2018 plus one-month accrued interest. The bonds mature on January 31, 2023. Interest in paid semiannually on July 31 and January 31, Brown's fiscal year ends on December 31 each year. The effective interest rate in 10%. What is the appropriate discount rate used to derive the present value of the bands on March 1, 2018? Select one: O a 5% b. 49 C. 10% od 8% e cannot be determined 05. Using the information in question 4, what is the journal entry to record the accrued interest that was included in the proceeds received from the bond sale on March 1, 2018? + 3,333 3,333 Select one: O a. Interest Expense 3,333 Cash Ob. Cash 3,333 Interest Payable OC. Interest Expense 4.166 Cash Od. Cash 4.166 Interest Payable 4,166 4,166

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts