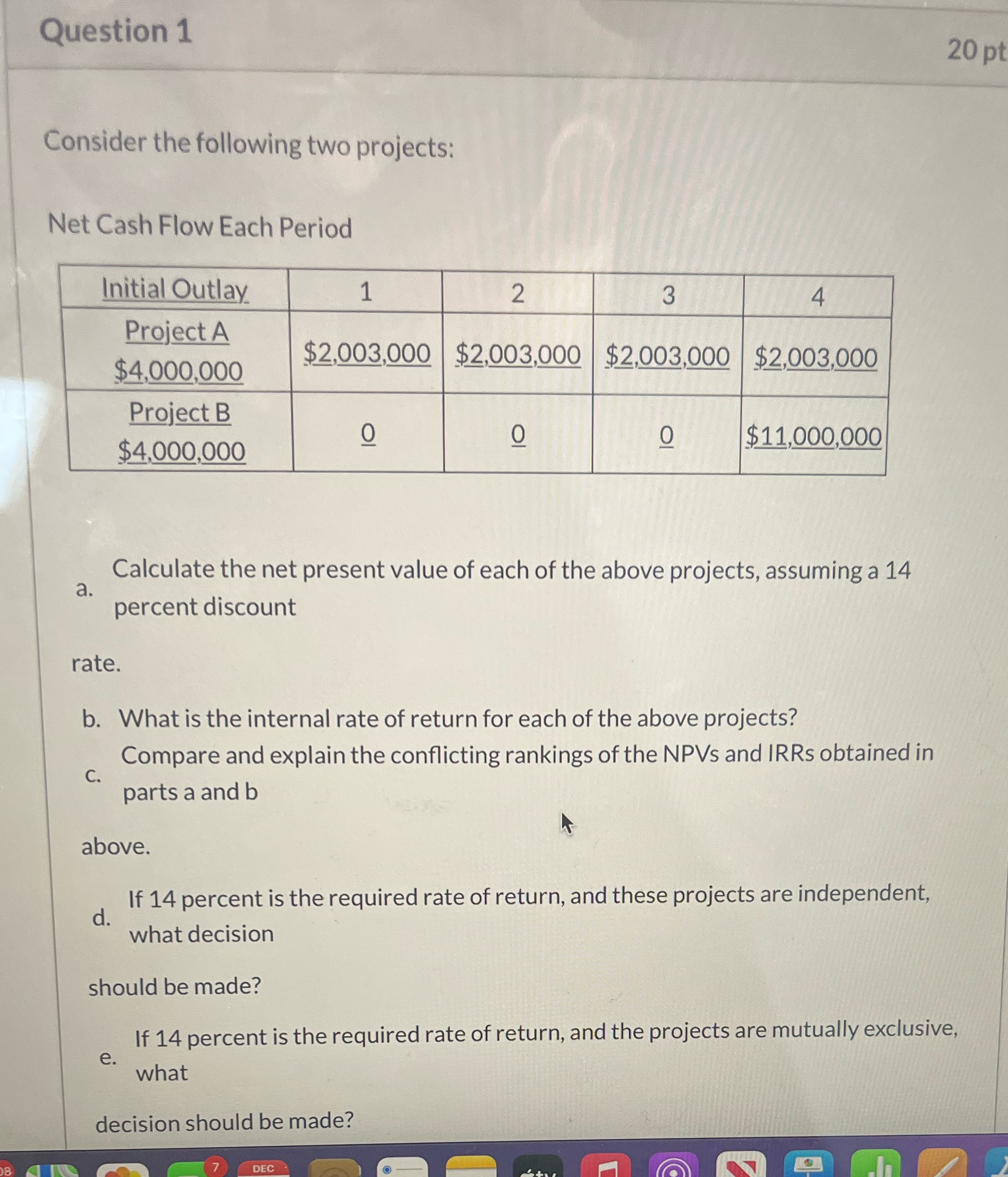

Question: 08 Question 1 Consider the following two projects: Net Cash Flow Each Period Initial Outlay 1 2 3 4 Project A $2,003,000 $2,003,000 $2,003,000

08 Question 1 Consider the following two projects: Net Cash Flow Each Period Initial Outlay 1 2 3 4 Project A $2,003,000 $2,003,000 $2,003,000 $2,003,000 $4,000,000 Project B $4,000,000 0 0 0 $11,000,000 20 pt a. rate. Calculate the net present value of each of the above projects, assuming a 14 percent discount b. What is the internal rate of return for each of the above projects? C. Compare and explain the conflicting rankings of the NPVS and IRRs obtained in parts a and b above. d. If 14 percent is the required rate of return, and these projects are independent, what decision should be made? e. If 14 percent is the required rate of return, and the projects are mutually exclusive, what decision should be made? DEC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts