Question: 08:37 68780 96% coursehero.com Documents Is this document missing answers: as 15 minutes = t Get Answers Get answers and explanations from our Expert Tutors

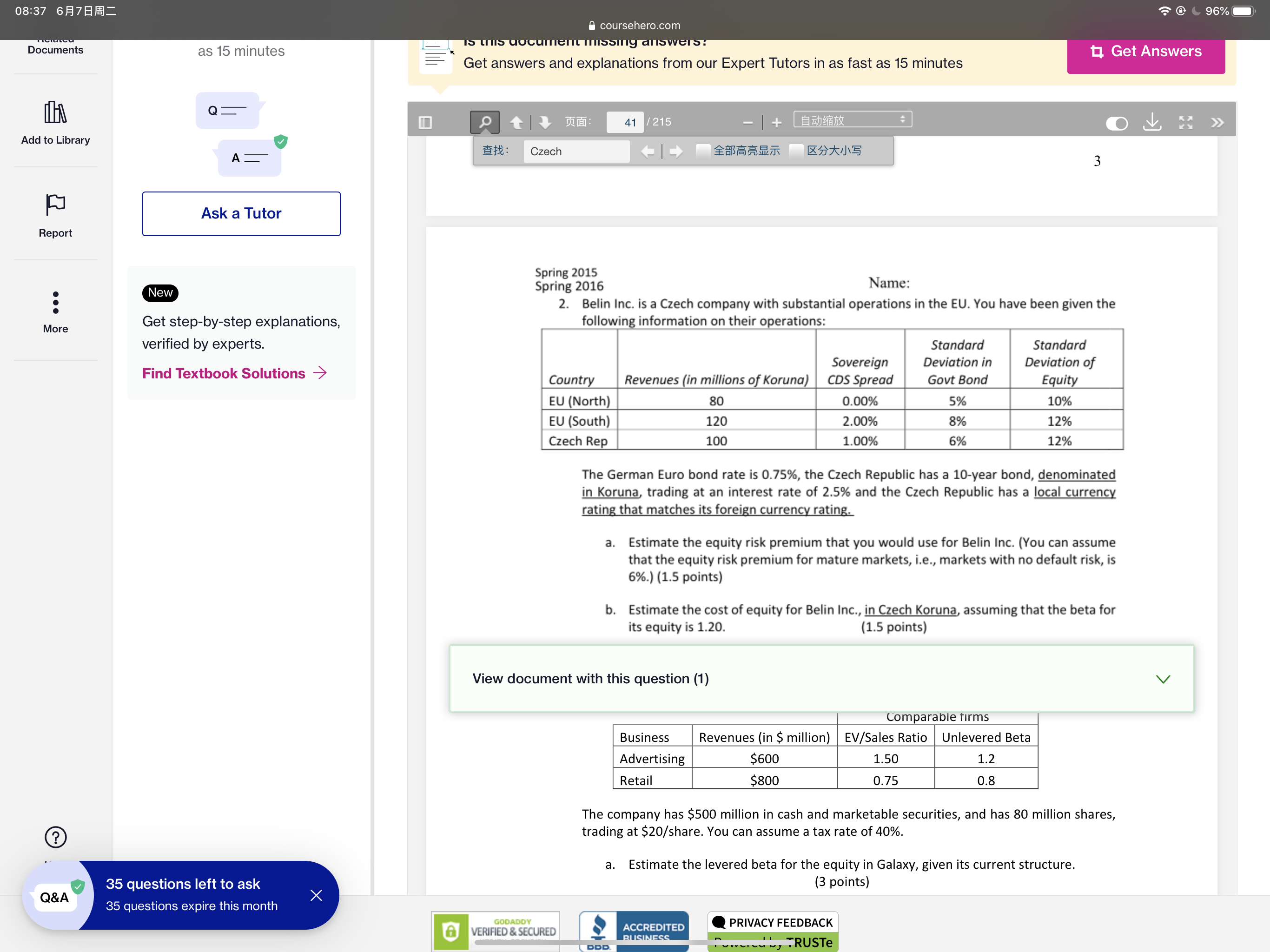

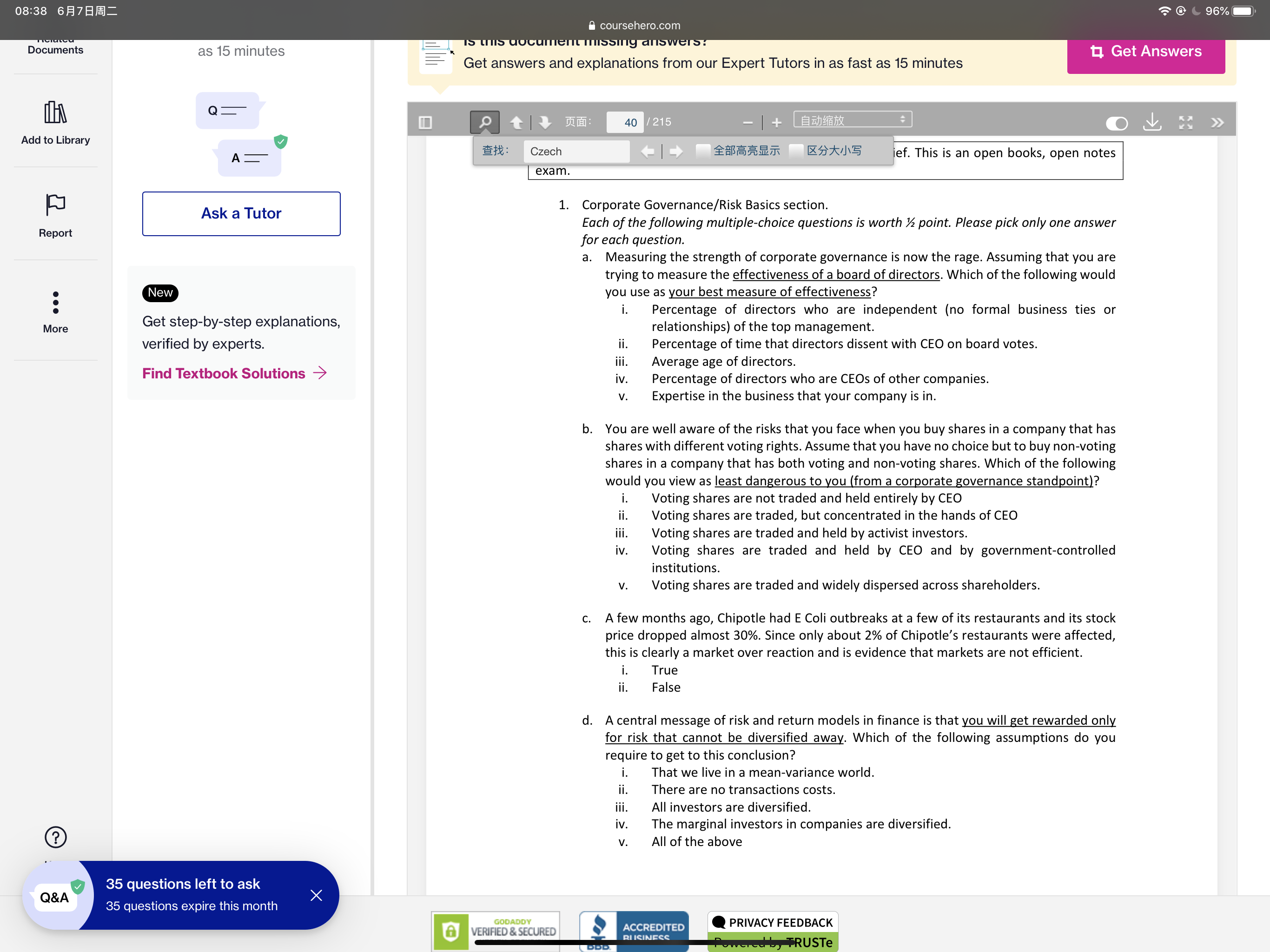

08:37 68780 96% coursehero.com Documents Is this document missing answers: as 15 minutes = t Get Answers Get answers and explanations from our Expert Tutors in as fast as 15 minutes Q_ 41 /215 -+ chak OLE >> Add to Library $ : Czech w Ask a Tutor Report Spring 2015 New Spring 2016 Name: . . . 2. Belin Inc. is a Czech company with substantial operations in the EU. You have been given the following information on their operations: More Get step-by-step explanations, verified by experts. Standard Standard Sovereign Deviation in Deviation of Find Textbook Solutions Country Revenues (in millions of Koruna) CDS Spread Govt Bond Equity EU (North) 80 0.00% 5% 10% EU (South) 120 2.00% 8% 12% Czech Rep 100 1.00% 6% 12% The German Euro bond rate is 0.75%, the Czech Republic has a 10-year bond, denominated in Koruna, trading at an interest rate of 2.5% and the Czech Republic has a local currency rating that matches its foreign currency rating. a. Estimate the equity risk premium that you would use for Belin Inc. (You can assume that the equity risk premium for mature markets, i.e., markets with no default risk, is 6%.) (1.5 points) Estimate the cost of equity for Belin Inc., in Czech Koruna, assuming that the beta for its equity is 1.20. (1.5 points) View document with this question (1) Comparable firms Business Revenues (in $ million) EV/Sales Ratio Unlevered Beta Advertising $600 1.50 1.2 Retail $800 0.75 0.8 The company has $500 million in cash and marketable securities, and has 80 million shares, ? trading at $20/share. You can assume a tax rate of 40%. a. Estimate the levered beta for the equity in Galaxy, given its current structure. 35 questions left to ask (3 points) Q&A X 35 questions expire this month GODADDY a ACCREDITED PRIVACY FEEDBACK VERIFIED & SECURED BUSINESS08:38 SENSE: Documents as 15 minutes m a: Add to Library 9 A _ P] Ask a Tutor Report : Get step-by-step explanations, verified by experts. More Find Textbook Solutions > g 35 questions left to ask Q&A 35 questions expire this month 3 coursehero com 1:]. Get Answers exam. GUDADov mmssminco 1. Corporate Governance/Risk Basics section. Each of the following multiple-choice questions is worth is point. Please pick only one answer for each question. a. Measuring the strength of corporate governance is now the rage. Assuming that you are trying to measure the W. Which of the following would you use as your best measure of effectiveness? i. Percentage of directors who are independent (no formal business ties or relationships) of the top management. ii. Percentage of time that directors dissent with CEO on board votes. iii. Average age ofdirectors. iv. Percentage of directors who are CEOs of other companies. v. Expertise in the business that your company is in. You are well aware of the risks that you face when you buy shares in a company that has shares with different voting rights. Assume that you have no choice but to buy non-voting shares in a company that has both voting and non-voting shares. Which of the following would you view as least dangerous to you (from a corporate governance standpoint)? i. Voting shares are not traded and held entirely by CEO ii. Voting shares are traded, but concentrated in the hands of CEO iii. Voting shares are traded and held by activist investors. iv. Voting shares are traded and held by CEO and by government-controlled institutions. v. Voting shares are traded and widely dispersed across shareholders. A few months ago, Chipotle had E Coli outbreaks at a few of its restaurants and its stock price dropped almost 30%. Since only about 2% of Chipotle's restaurants were affected, this is clearly a market over reaction and is evidence that markets are not efficient. i. True ii. False A central message of risk and return models in finance is that youwigw for risk that cannot be diversied away. Which of the following assumptions do you require to get to this conclusion? i. That we live in a mean-variance world. ii. There are no transactions costs. iii. All investors are diversified. iv. The marginal investors in companies are diversified. v. All ofthe above PRIVACV FEEDBACK \\ CCREDITED iiqwmc ?@

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts