Question: 08:47 1 vil LTE + CLASS EXERCISE O... CLASS EXERCISE ON MATERIAL VALUATION Question ! On 1 January 2018, Hopkins Limited had an opening balance

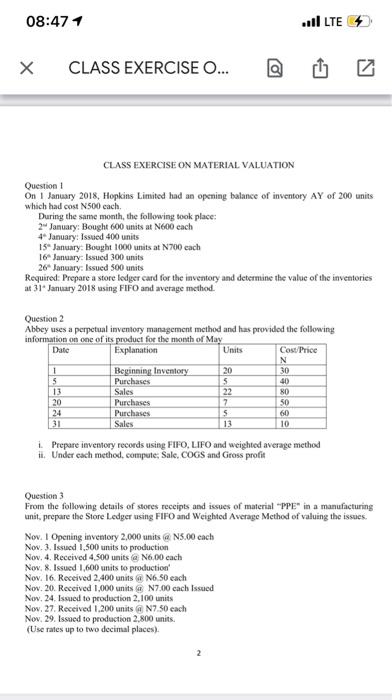

08:47 1 vil LTE + CLASS EXERCISE O... CLASS EXERCISE ON MATERIAL VALUATION Question ! On 1 January 2018, Hopkins Limited had an opening balance of inventory AY of 200 units During the same month, the following took place: 2 January: Bought 600 units at N600 each 4. January: Issued 400 units 15 January. Bought 1000 units at N200 each 16 January: Issued 300 units 26 January: Issued 500 units Required: Prepare a store lodger card for the inventory and determine the value of the inventories at 31 January 2018 using FIFO and average method. Question 2 Abbey uses a perpetual inventory management method and has provided the following information on one of its product for the month of May Date Explanation Units Cost Price N 1 Beginning Inventory 20 30 5 Purchases 5 13 Sales 22 20 Purchases 7 50 24 Purchases S 31 Sales 13 10 1. Prepare inventory records using FIFO, LIFO and weighted average method #. Under cach method, compute, Sale, COGS and Gross profit Question 3 From the following details of stores receipts and issues of material "PPE" in a manufacturing unit, prepare the Store Ledger using FIFO and Weighted Average Method of valuing the issues. Nov. 1 Opening inventory 2,000 units N5.00 each Nov. 3. Issued 1,500 units to production Nov. 4. Received 4.500 units N6.00 each Nov. 8.Issued 1.600 units to production Nov. 16. Received 2,400 units N6.50 each Nov. 20. Received 1,000 units @ N7.00 cach Issued Nov. 24. Issued to production 2.100 units Nov. 27. Received 1.200 units @ N7.50 each Nov. 29. Issued to production 2,800 units. (Use rates up to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts