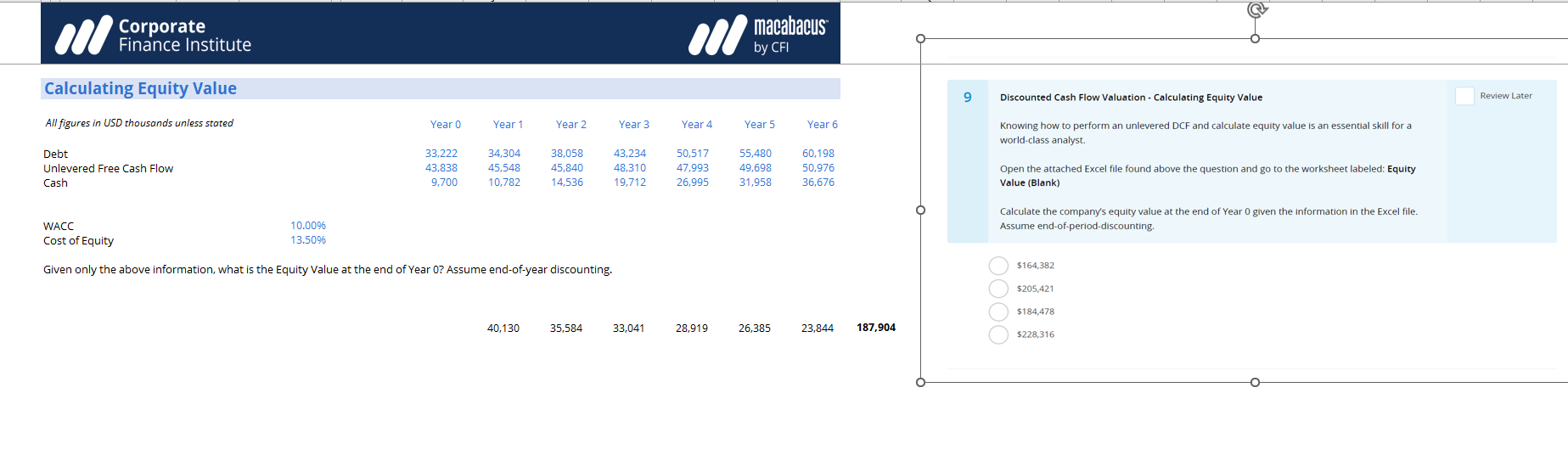

Question: 09 CALCULATING EQUITY VALUE CORRECT ANSWER IS NOT IN LIST OF MULTIPLE CHOICE ANSWERS Calenlatina Fnnith //aluo WACC Cost of Equity Given only the above

09 CALCULATING EQUITY VALUE

CORRECT ANSWER IS NOT IN LIST OF MULTIPLE CHOICE ANSWERS

Calenlatina Fnnith //aluo WACC Cost of Equity Given only the above information, what is the Equity Value at the end of Year 0? Assume end-of-year discounting. 35,584 187,904 9 Discounted Cash Flow Valuation - Calculating Equity Value Review Lat Knowing how to perform an unlevered DCF and calculate equity value is an essential skill for a world-class analyst. Open the attached Excel file found above the question and go to the worksheet labeled: Equity Value (Blank) Calculate the company's equity value at the end of Year 0 given the information in the Excel file. Assume end-of-period-discounting. $164,382 $205,421 $184,478 $228,316 Calenlatina Fnnith //aluo WACC Cost of Equity Given only the above information, what is the Equity Value at the end of Year 0? Assume end-of-year discounting. 35,584 187,904 9 Discounted Cash Flow Valuation - Calculating Equity Value Review Lat Knowing how to perform an unlevered DCF and calculate equity value is an essential skill for a world-class analyst. Open the attached Excel file found above the question and go to the worksheet labeled: Equity Value (Blank) Calculate the company's equity value at the end of Year 0 given the information in the Excel file. Assume end-of-period-discounting. $164,382 $205,421 $184,478 $228,316

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts