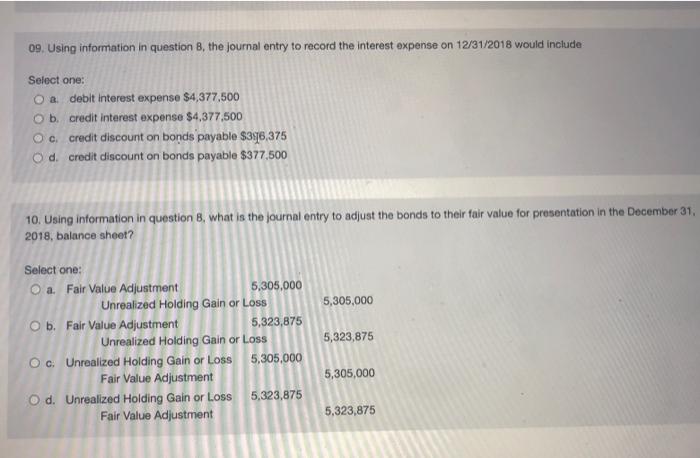

Question: 09. Using information in question 8, the journal entry to record the interest expense on 12/31/2018 would include Select one: O debit interest expense $4,377,500

09. Using information in question 8, the journal entry to record the interest expense on 12/31/2018 would include Select one: O debit interest expense $4,377,500 Ob credit interest expense $4,377,500 Occredit discount on bonds payable $3976375 Od credit discount on bonds payable $377,500 10. Using information in question 8, what is the journal entry to adjust the bonds to their fair value for presentation in the December 31, 2018, balance sheet? 5,305,000 Select one: O a Fair Value Adjustment 5,305,000 Unrealized Holding Gain or Loss O b. Fair Value Adjustment 5,323,875 Unrealized Holding Gain or Loss Oc Unrealized Holding Gain or Loss 5,305,000 Fair Value Adjustment O d. Unrealized Holding Gain or Loss 5,323,875 Fair Value Adjustment 5,323,875 5,305,000 5,323,875

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts