Question: 09-65A. (Learning Objective 1: Measure and report current liabilities) Gulfshore Marine experienced these events during the current year. a. December revenue totaled $180,000; and, in

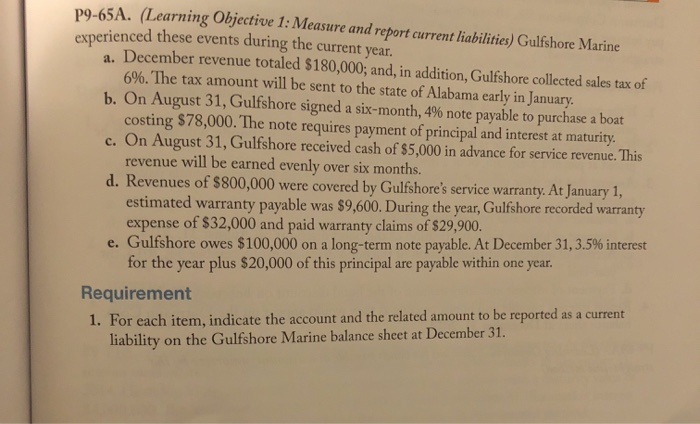

09-65A. (Learning Objective 1: Measure and report current liabilities) Gulfshore Marine experienced these events during the current year. a. December revenue totaled $180,000; and, in addition, Gulfshore collected sales tax of 6%. The tax amount will be sent to the state of Alabama early in January b. On August 31, Gulfshore signed a six-month, 4% note payable to purchase a boat costing $78,000. The note requires payment of principal and interest at maturity. c. On August 31, Gulfshore received cash of $5,000 in advance for service revenue. This revenue will be earned evenly over six months. d. Revenues of $800,000 were covered by Gulfshore's service warranty. At January 1, estimated warranty payable was $9,600. During the year, Gulfshore recorded warranty expense of $32,000 and paid warranty claims of $29,900. e. Gulfshore owes $100,000 on a long-term note payable. At December 31, 3.5% interest for the year plus $20,000 of this principal are payable within one year. Requirement 1. For each item, indicate the account and the related amount to be reported as a current liability on the Gulfshore Marine balance sheet at December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts