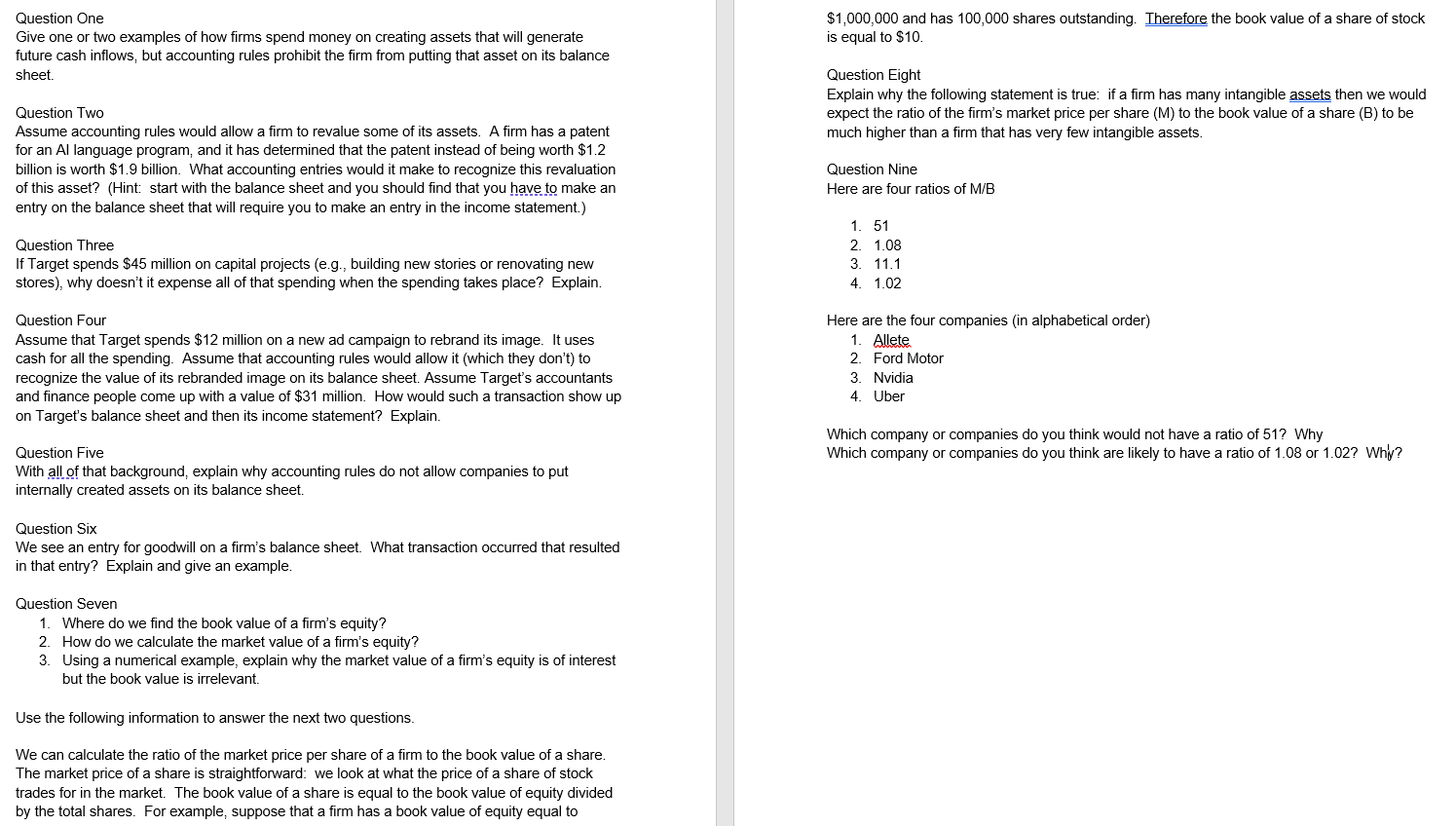

Question: $ 1 , 0 0 0 , 0 0 0 and has 1 0 0 , 0 0 0 shares outstanding. Therefore the book value

$ and has shares outstanding. Therefore the book value of a share of stock

is equal to $

Question Eight

Explain why the following statement is true: if a firm has many intangible assets then we would

expect the ratio of the firm's market price per share to the book value of a share to be

much higher than a firm that has very few intangible assets.

Question Nine

Here are four ratios of MB

Here are the four companies in alphabetical order

Allete

Ford Motor

Nvidia

Uber

Which company or companies do you think would not have a ratio of Why

Which company or companies do you think are likely to have a ratio of or Why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock