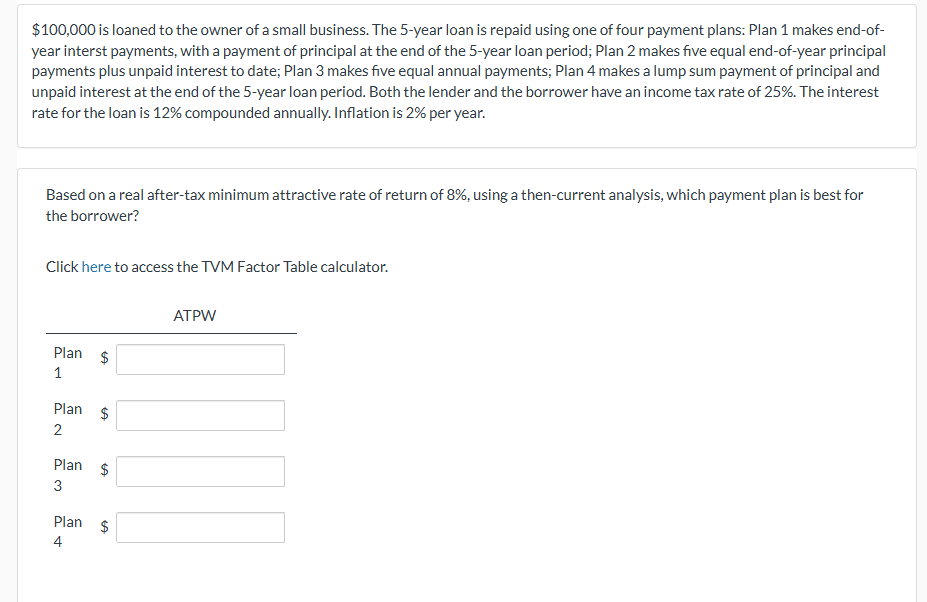

Question: ( $ 1 0 0 , 0 0 0 ) is loaned to the owner of a small business. The 5 -

$ is loaned to the owner of a small business. The year loan is repaid using one of four payment plans: Plan makes endofyear interst payments, with a payment of principal at the end of the year loan period; Plan makes five equal endofyear principal payments plus unpaid interest to date; Plan makes five equal annual payments; Plan makes a lump sum payment of principal and unpaid interest at the end of the year loan period. Both the lender and the borrower have an income tax rate of The interest rate for the loan is compounded annually. Inflation is per year. Based on a real aftertax minimum attractive rate of return of using a thencurrent analysis, which payment plan is best for the borrower? Click here to access the TVM Factor Table calculator. ATPW Plan Plan $ Plan $ Plan

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock