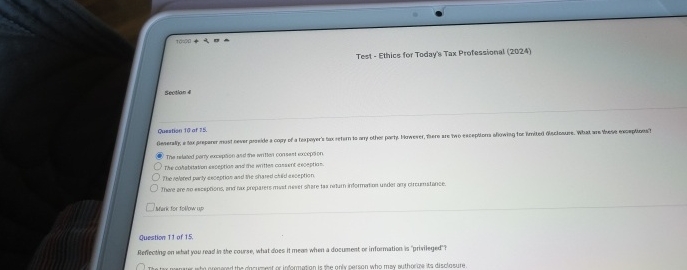

Question: 1 0 0 0 0 Test - Ethics for Today's Tax Protessional ( 2 0 2 4 ) Secolon 4 Question 1 0 of 7

Test Ethics for Today's Tax Protessional

Secolon

Question of

The ralaved porty excrupsion and tha willen consent excepsion

The cohabstation eseeption and the mithen cansinc enception.

The reloved purty enception and the shaped child exception

There are no encipoons, and tax propares must never share tas raturn informstron under ary clicamatance.

Mark for follow up

Question of

Refiecting en usat you read in the course, what does it mean when a document or information is 'privileged'?

Tha tax manatis a ba erenaed the docuenterinfemention is the only person who moy suthorice its disclosure.

estion of

cular authorizes Lisa to sign, as the preparer, a tax return that:

Reports a $ loss from an investment with no documentation or written opinion.

Shows zero income tax due and includes a claim that filing and paying income taxes are voluntary.

Takes a nonfrivolous position and has substantial authority for the position.

Takes an undisclosed position that Lisa has not encountered before and does not have time to resea

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock