Question: 1 0 / 1 1 / 2 4 , 1 : 4 1 PM Training detaik Curriculum Nella sells shares of stock she acquired by

: PM

Training detaik Curriculum

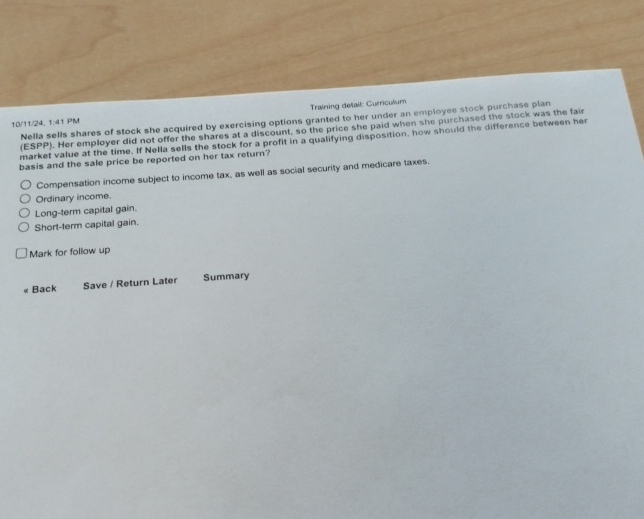

Nella sells shares of stock she acquired by exercising options granted to her under an employee stock purchase plan

ESPP Her employer did not offer the shares at a discount, so the price she paid when she purchased the stock was the fair

market value at the time. If Nella sells the stock for a profit in a qualifying disposition, how should the difference between her

basis and the sale price be reported on her tax return?

Compensation income subject to income tax, as well as social security and medicare taxes.

Orcinary income.

Longterm capital gain.

Shortterm capital gain.

Mark for follow up

Summary

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock