Question: 1 0 1 5 2 4 , 7 1 3 5 A M Training detail: Curriculum Test - Claiming a Refund for a Decedent (

Training detail: Curriculum

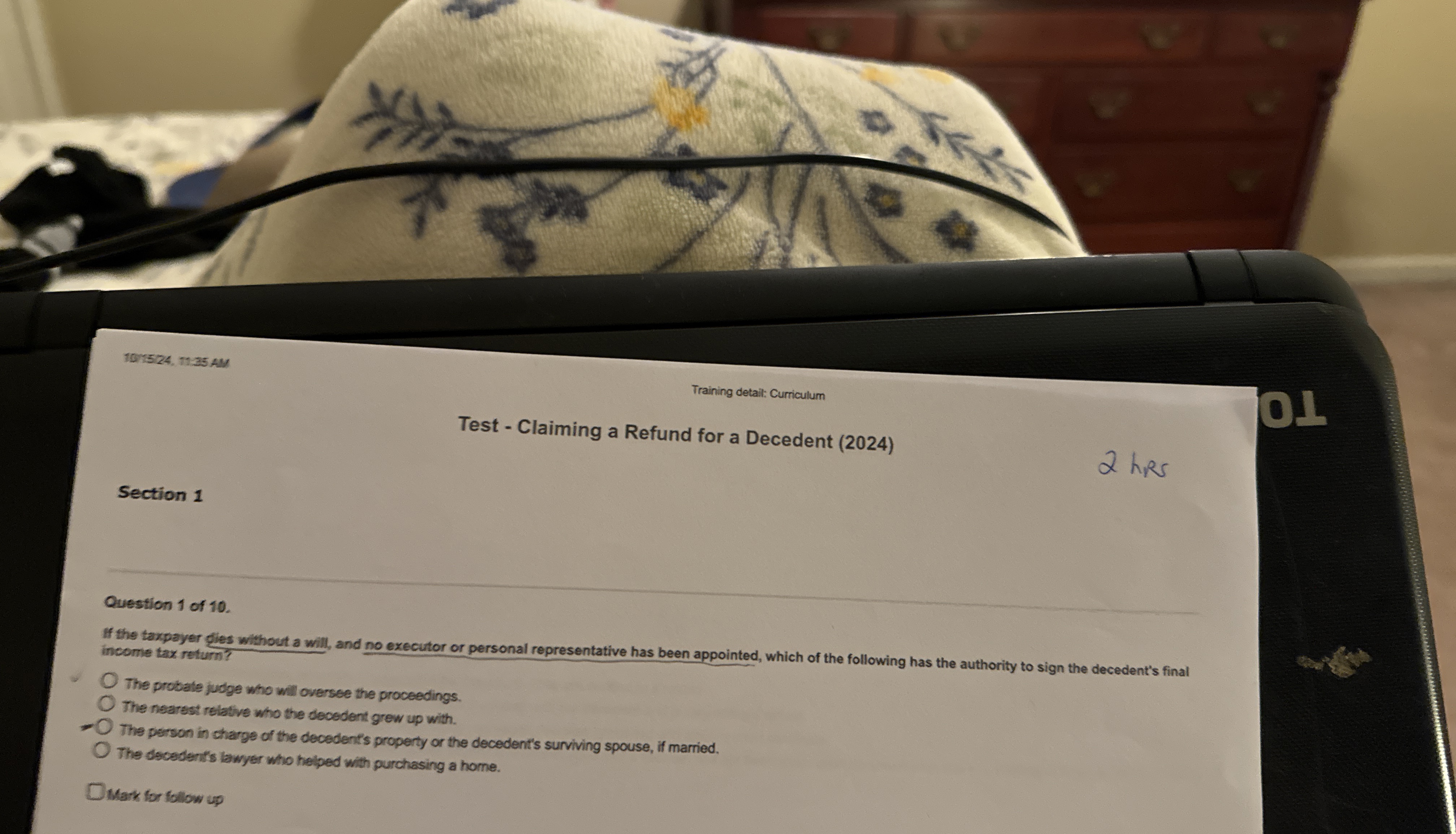

Test Claiming a Refund for a Decedent

Section

Question of

If the taxpayer dies without a will, and no executor or personal representative has been appointed, which of the following has the authority to sign the decedent's final income tax returm?

The probate judge who will oversee the proceedings.

The nearest relative who the decodent grew up with.

The person in charge of the decedent's property or the decedent's surviving spouse, if married.

The docadent's lawyer who holped with purchasing a home.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock