Question: 1 0 5 ? 2 4 , 7 : 1 3 P M Appendix C: Specimen Financial Statements: The Coca - Cola Company Dividends (

:

Appendix C: Specimen Financial Statements: The CocaCola Company

Dividends per share $$ and $ in and :

respectively

tableBalance at end of year,Accumulated Other Comprehensive Income LossBalance at beginning of year,Adoption of accounting standardsNet other comprehensive income lossBalance at end of year,

Treasury Stock

Balance at beginning of year

Treasury stock issued to employees related to stockbased compensation

plans

tablePurchases of stock for treasury,Balance at end of year,Total Equity Attributable to Shareowners of The CocaCola Company, $

Equity Attributable to Noncontrolling InterestsBalance at beginning of year,$ $ $ Net income attributable to noncontrolling interests,Net foreign currency translation adjustments,Dividends paid to noncontrolling interests,Acquisition of interests held by noncontrolling owners,Contributions by noncontrolling interests,Business combinations,Other activities,Total Equity Attributable to Noncontrolling Interests,$ $$

Refer to Note and Note

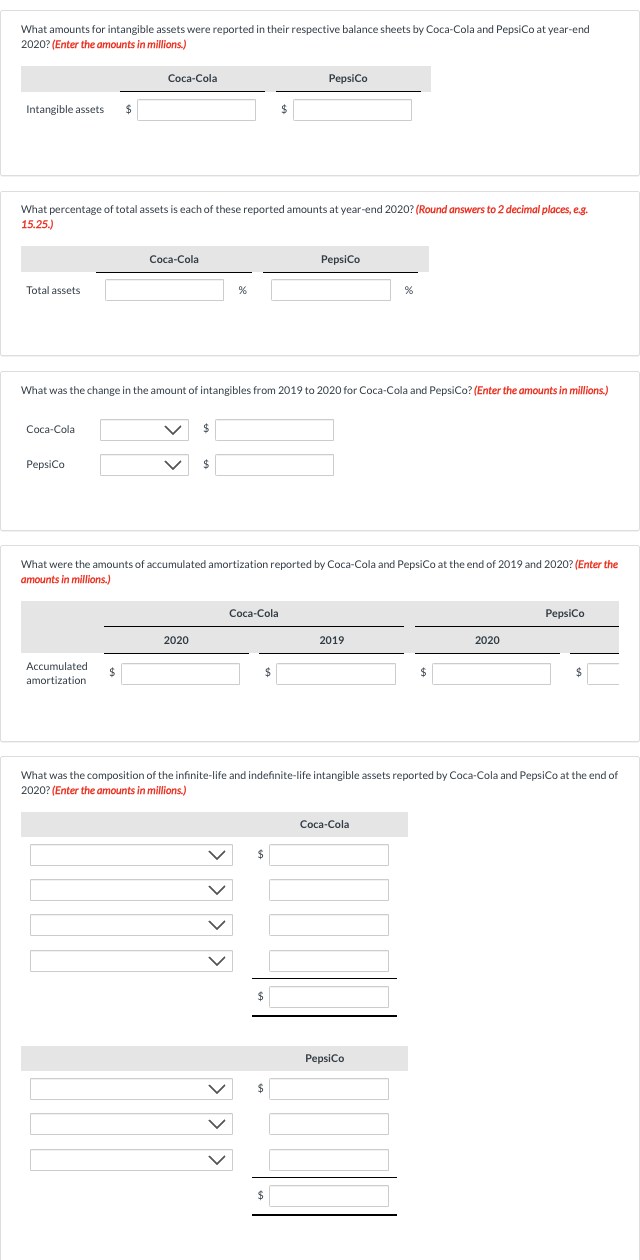

What amounts for intangible assets were reported in their respective balance sheets by CocaCola and PepsiCo at yearend

Enter the amounts in millions.

What percentage of total assets is each of these reported amounts at yearend Round answers to decimal places, eg

What was the change in the amount of intangibles from to for CocaCola and PepsiCo? Enter the amounts in millions.

CocaCola

$

PepsiCo

$

What were the amounts of accumulated amortization reported by CocaCola and PepsiCo at the end of and Enter the

amounts in millions.

What was the composition of the infinitelife and indefinitelife intangible assets reported by CocaCola and PepsiCo at the end of

Enter the amounts in millions.

CocaCola

$

$

PepsiCo

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock