Question: 1 0 . 9 Determine the Allowable deduction items, according to tax Australian Tax legislation ( ITAA 9 7 , Etc. ) 3 0 June

Determine the Allowable deduction items, according to tax Australian Tax legislation ITAA Etc. June based on the following information.

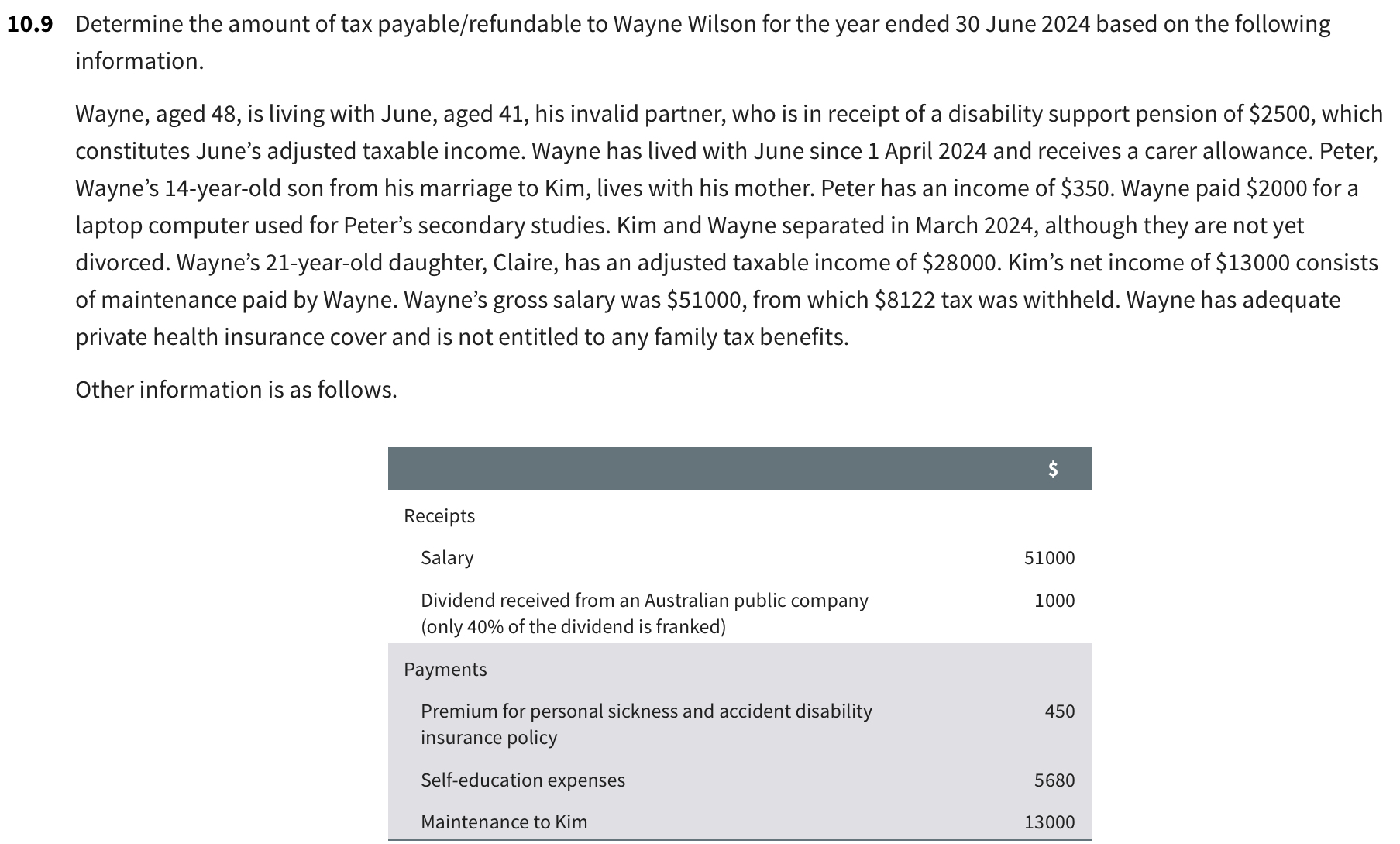

Wayne, aged is living with June, aged his invalid partner, who is in receipt of a disability support pension of $ which constitutes June's adjusted taxable income. Wayne has lived with June since April and receives a carer allowance. Peter, Wayne's yearold son from his marriage to Kim, lives with his mother. Peter has an income of $ Wayne paid $ for a laptop computer used for Peter's secondary studies. Kim and Wayne separated in March although they are not yet divorced. Wayne's yearold daughter, Claire, has an adjusted taxable income of $ Kim's net income of $ consists of maintenance paid by Wayne. Wayne's gross salary was $ from which $ tax was withheld. Wayne has adequate private health insurance cover and is not entitled to any family tax benefits.

Other information is as follows.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock