Question: 1 0 . How does the classification of short - term debt differ between US GAAP and IFRS? Both US GAAP and IFRS both allow

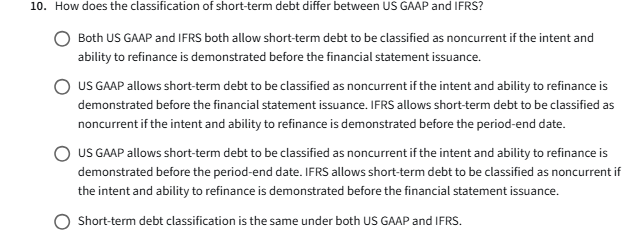

How does the classification of shortterm debt differ between US GAAP and IFRS?

Both US GAAP and IFRS both allow shortterm debt to be classified as noncurrent if the intent and ability to refinance is demonstrated before the financial statement issuance.

US GAAP allows shortterm debt to be classified as noncurrent if the intent and ability to refinance is demonstrated before the financial statement issuance. IFRS allows shortterm debt to be classified as noncurrent if the intent and ability to refinance is demonstrated before the periodend date.

US GAAP allows shortterm debt to be classified as noncurrent if the intent and ability to refinance is demonstrated before the periodend date. IFRS allows shortterm debt to be classified as noncurrent if the intent and ability to refinance is demonstrated before the financial statement issuance.

Shortterm debt classification is the same under both US GAAP and IFRS.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock