Question: 1 . 0 IntroductionThe Internal Audit Unit headed by the Chief Internal Auditor ( CIA ) of Mandabovu CaffeeBoard ( MCB ) has been credited

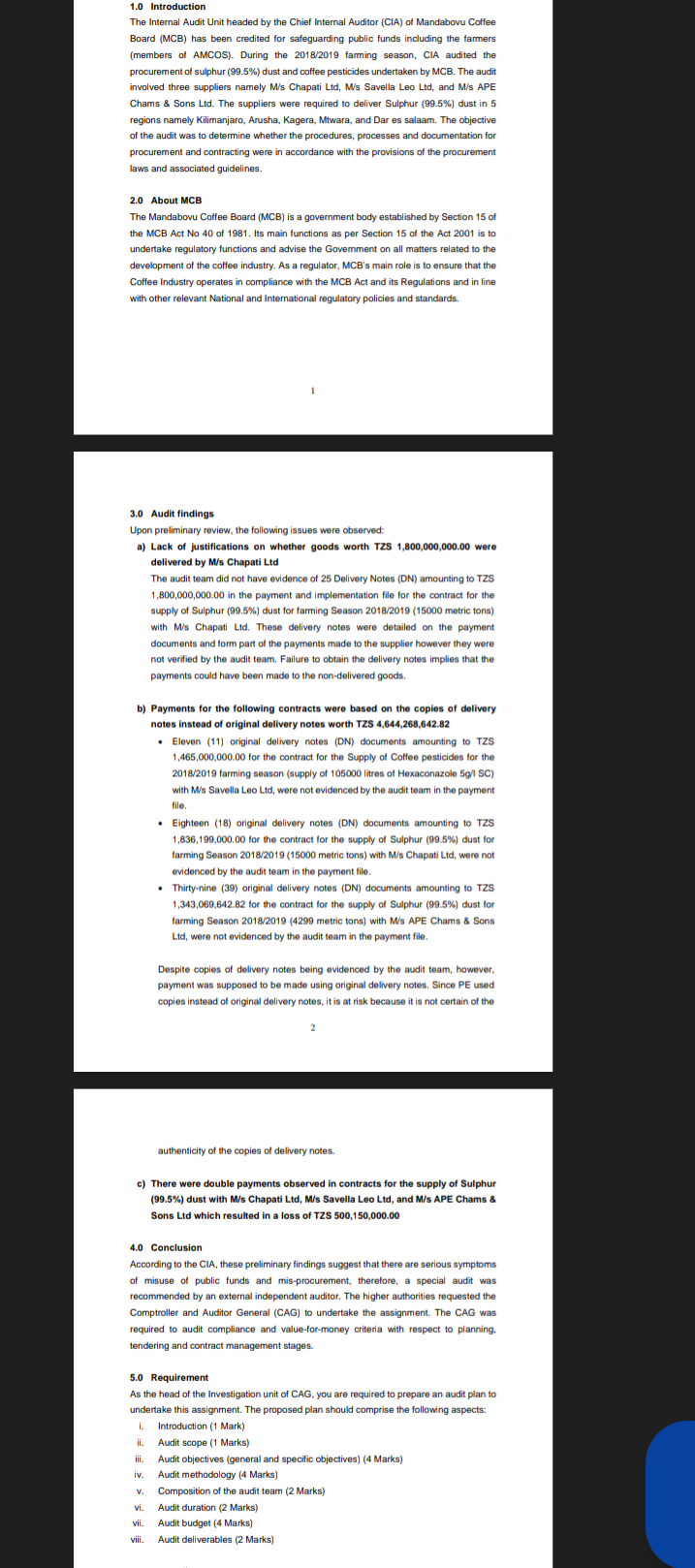

IntroductionThe Internal Audit Unit headed by the Chief Internal Auditor CIA of Mandabovu CaffeeBoard MCB has been credited for safeguarding public funds including the farmersmembers f AMCOS During the faming season, CIA audited theprocurement of sulphur dust and coffee pesticides undertaken by MCB The auditinvolved three suppliers namely Ms Chapati Ltd Ms Savela Leo Ltd and Ms APEChams & Sons Ltd The suppliers were required to deliver Sulphur dust in regions namely Kilimanjaro, Arusha, Kagera, Mtwara, and Dar es salaam. The objectiveof the audit was to determine whether the procedures, processes and documentation forprocurement and contracting were in accordance with the provisions of the procurementlaws and associated guidelines About MCBThe Mandabovu Cofee Board MCB is a government body established by Section ofrCectioe ot the Act o is toper Section Tthe MCB Act No of Its main tuundertake regulatory functions and advise the Govemment on all matters related to thedevelopment of the coffee industry. As a regulator, MCBs main role is to ensure that theCoffee Industry operates in compliance with the MCB Act and its Requlations and in linewith other relevant National and International regulatory policies and standards Audit findingsUpon preliminary review, the following issues were observed:a Lack of justifications on whether goods worth TZS weredelivered by Ms Chapati LtdThe audit team did not have evidence of Delivery Notes DN amounting to TZs in the payment and implementation file for the contract for thesupply of Sulphur dust for farming Season metric tonswith Ms Chapati Ld These delivery notes were detailed on the paymentdocuments and form part of the payments made to the supplier however they werenot verified by the audit team. Failure to obtain the delivery notes implies that thepayments could have been made to the nondelivered goods.b Payments for the following contracts were based on the copies of deliverynotes instead of original delivery notes worth TZS Eleven original delivery notes DN documents amounting to TZs for the contract for the Supply of Coffee pesticides for the farming season supply of litres of Hexaconazole gl SCwith Ms Savella Leo Ltd were not evidenced by the audit team in the paymentfile. Eighteen original delivery notes DN documents amounting to TZS for the contract for the supply of Sulphur dust forfarming Season metric tons with Ms Chapati Ltd were notevidenced by the audit team in the payment file. Thirtynine original delivery notes DN documents amounting to TZs for the contract for the supply of Sulphur dust forfarming Season metric tons with Mis APE Chams & SonsLtd, were not evidenced by the audit team in the payment file.Despite copies of delivery notes being evidenced by the audit team, however,payment was supposed to be made using original delivery notes. Since PE usedcopies instead of original delivery notes, it is at risk because it is not certain of theauthenticity of the copies of delivery notes.c There were double payments observed in contracts for the supply of Sulphur dust with Ms Chapati Ltd Ms Savella Leo Ltd and Ms APE Chams &Sons Ltd which resuted in a loss of TS iy ConclusionAccording to the ClA, these preliminary findings suggest that there are serious symptomsof misuse of public funds and misprocurement, therefore, a special audit wasrecommended by an external independent auditor. The higher authorities requested theComptroller and Auditor General CAG to undertake the assignment. The CAG wasrequired to audit compliance and valueformoney criteria with respect to planning,tendering and contract management stages RequirementAs the head of the Investigation unit of CAG. you are required to prepare an audit plan toundertake this assignment. The proposed plan should comprise the following aspectsi. Introduction MarkAudit scope MarksAudit objectives general and specific objectives MarksAudit methodology MarksComposition of the audit team MarksAudit duration MarksAudit budget MarksAudit deliverables Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock