Question: ( 1 0 points ) a . What is the underlying assumption for setting a single objective of value maximization for a firm? b .

points

a What is the underlying assumption for setting a single objective of value maximization

for a firm?

b Is value maximization a proper objective that benefits society as a whole or a flawed

one? How do the agency theory's and the stakeholder theory's answers to this question

differ?

c Can the modern fim have multiple objectives? If so what is the critical information

needed for achieving the goals of the firm? If not, why?

d Please discuss the approaches of the agency theory and the stakeholder theory to the

modern firm's objectives in light of the increased focus on ESG and CSR

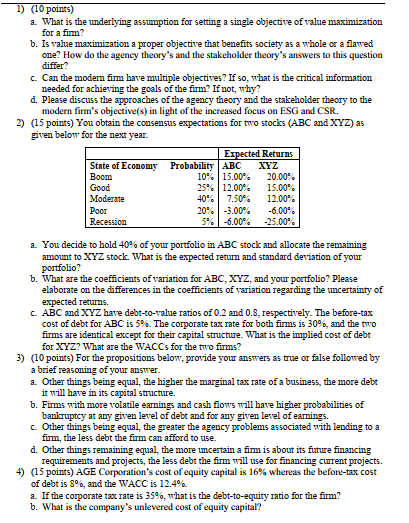

points You obtain the consensus expectations for two stocks ABC and XYZ as

given below for the next year.

a You decide to hold of your portfolio in ABC stock and allocate the remaining

amount to XYZ stock. What is the expected return and standard deviation of your

portfolio?

b What are the coefficients of variation for ABC, and your portfolio? Please

elaborate on the differences in the coefficients of variation regarding the uncertainty of

expected returns.

c ABC and have debttovalue ratios of and respectively. The beforetax

cost of debt for ABC is The corporate tax rate for both firms is and the two

firms are identical except for their capital structure. What is the implied cost of debt

for XYZ What are the WACCs for the two firms?

points For the propositions below, provide your answers as true or false followed by

a brief reasoning of your answer.

a Other things being equal, the higher the marginal tax rate of a business, the more debt

it will have in its capital structure.

b Firms with more volatile earnings and cash flows will have higher probabilities of

bankruptcy at any given level of debt and for any given level of earnings.

c Other things being equal, the greater the agency problems associated with lending to a

firm, the less debt the firm can afford to use.

d Other things remaining equal, the more uncertain a firm is about its future financing

requirements and projects, the less debt the firm will use for financing current projects.

points AGE Corporation's cost of equity capital is whereas the beforetax cost

of debt is and the WACC is

a If the corporate tax rate is what is the debttoequity ratio for the firm?

b What is the company's unlevered cost of equity capital?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock