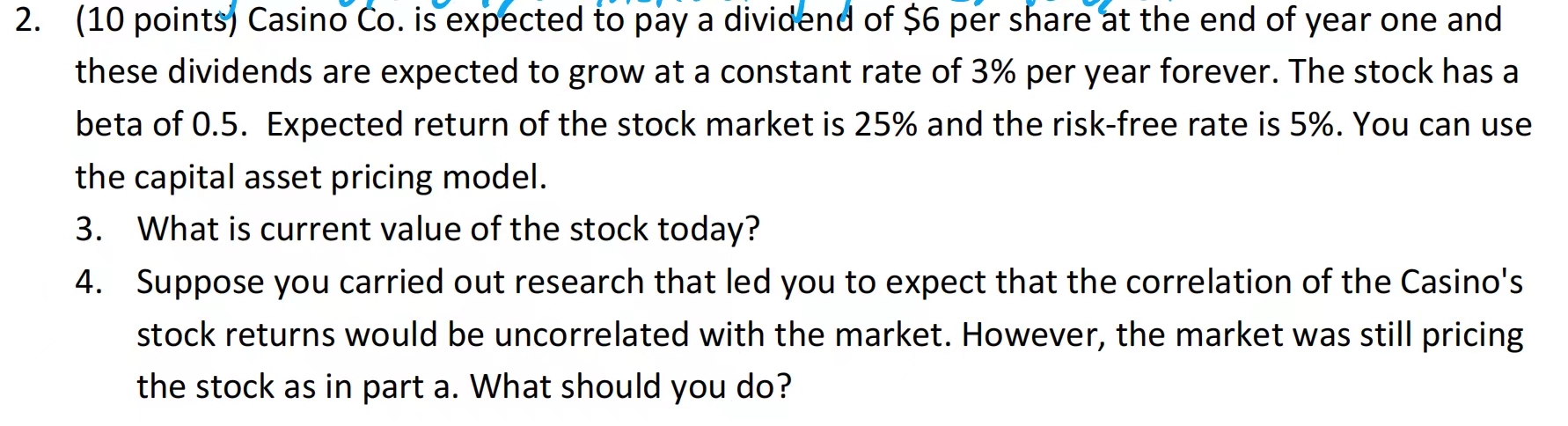

Question: ( 1 0 points ) Casino Co . is expected to pay a dividend of $ 6 per share at the end of year one

points Casino Co is expected to pay a dividend of $ per share at the end of year one and these dividends are expected to grow at a constant rate of per year forever. The stock has a beta of Expected return of the stock market is and the riskfree rate is You can use the capital asset pricing model.

What is current value of the stock today?

Suppose you carried out research that led you to expect that the correlation of the Casino's stock returns would be uncorrelated with the market. However, the market was still pricing the stock as in part a What should you do

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock