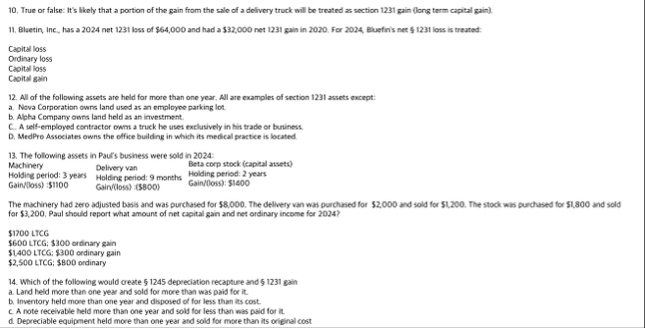

Question: 1 0 . True or false: It's likely that a portion of the gain from the sale of a delivery truck will be treated as

True or false: It's likely that a portion of the gain from the sale of a delivery truck will be treated as section gain long term capital gain

Bluetin, Inc., has a net loss of $ and had a $ net gain in For Bluefin's net loss is treated:

A Capital loss

b Ordinary loss

C Capital loss

D Capital gain

All of the following assets are held for more than one year. All are examples of section assets except:

a Nova Corporation owns land used as an employee parking lot

b Alpha Company owns land held as an investment.

C A selfemployed contractor owns a truck he uses exclusively in his trade or business.

D MedPro Associates owns the office building in which its medical practice is located.

The following assets in Paul's business were sold in :

Machinery

Holding period: years

Gainloss :$

Delviery van:

Holding period: months

Gainloss:

Beta corp stock capital asset

Holding period: years

Gainloss: $

The machinery had zero adjusted basis and was purchased for $ The delivery van was purchased for $ and sold for $ The stock was purchased for $ and sold for $ Paul should report what amount of net capital gain and net ordinary income for

a $ LTCG

B $ LTCG; $ ordinary gain

C $ LTCG; $ ordinary gain

D $ LTCG; $ ordinary

Which of the following would create depreciation recapture and gain

a Land held more than one year and sold for more than was paid for it

b Inventory held more than one year and disposed of for less than its cost.

C A note receivable held more than one year and sold for less than was paid for it

d Depreciable equipment held more than one year and sold for more than its original cost

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock