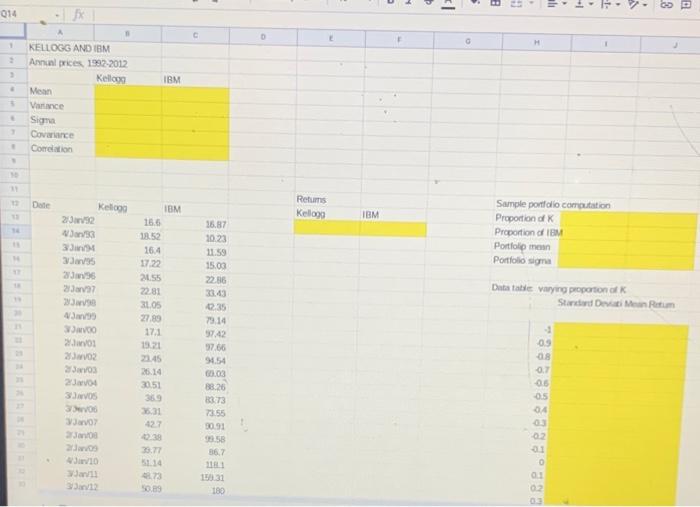

Question: . -1 - 1 014 C 1 H IBM KELLOGG AND IBM Annual prices 1992-2012 Kello Mean Varance Signa Covance Correlation Date Kelio Returns Kellogg

. -1 - 1 014 C 1 H IBM KELLOGG AND IBM Annual prices 1992-2012 Kello Mean Varance Signa Covance Correlation Date Kelio Returns Kellogg IBM 2:33 16.87 20.23 11.59 Sample portfolio computation Proportion of Proportion of IBM Portfolip menn Portfolio Sigma 3 Jan 3/35 15.00 22.86 1 IBM 16.5 18.52 16.4 17.22 21.55 22.81 3105 27.89 17.1 13.21 2245 26.14 3051 Datatable varying proportion of Standard De Ritum 2 Jan 27 2. W/ Javo 2. 23 Vos 20 3 VOS 3 JAVO no 27 10 Jan 33 09 08 07 235 79.14 57.42 57.66 9454 6.03 38.26 33.73 7355 30.91 58 36.7 11 10331 180 05 31 427 ees 0 02 341 0 0 51.14 2.73 50.89 03 H K L 0.4 0.5 0.6 0.7 0.8 0.9 1 . -1 - 1 014 C 1 H IBM KELLOGG AND IBM Annual prices 1992-2012 Kello Mean Varance Signa Covance Correlation Date Kelio Returns Kellogg IBM 2:33 16.87 20.23 11.59 Sample portfolio computation Proportion of Proportion of IBM Portfolip menn Portfolio Sigma 3 Jan 3/35 15.00 22.86 1 IBM 16.5 18.52 16.4 17.22 21.55 22.81 3105 27.89 17.1 13.21 2245 26.14 3051 Datatable varying proportion of Standard De Ritum 2 Jan 27 2. W/ Javo 2. 23 Vos 20 3 VOS 3 JAVO no 27 10 Jan 33 09 08 07 235 79.14 57.42 57.66 9454 6.03 38.26 33.73 7355 30.91 58 36.7 11 10331 180 05 31 427 ees 0 02 341 0 0 51.14 2.73 50.89 03 H K L 0.4 0.5 0.6 0.7 0.8 0.9 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts