Question: 1 1 / 1 8 / 2 4 , 4 : 1 6 PM Question 5 2 of 7 5 . Realize Your Potential: H&R

: PM

Question of

Realize Your Potential: H&R Block

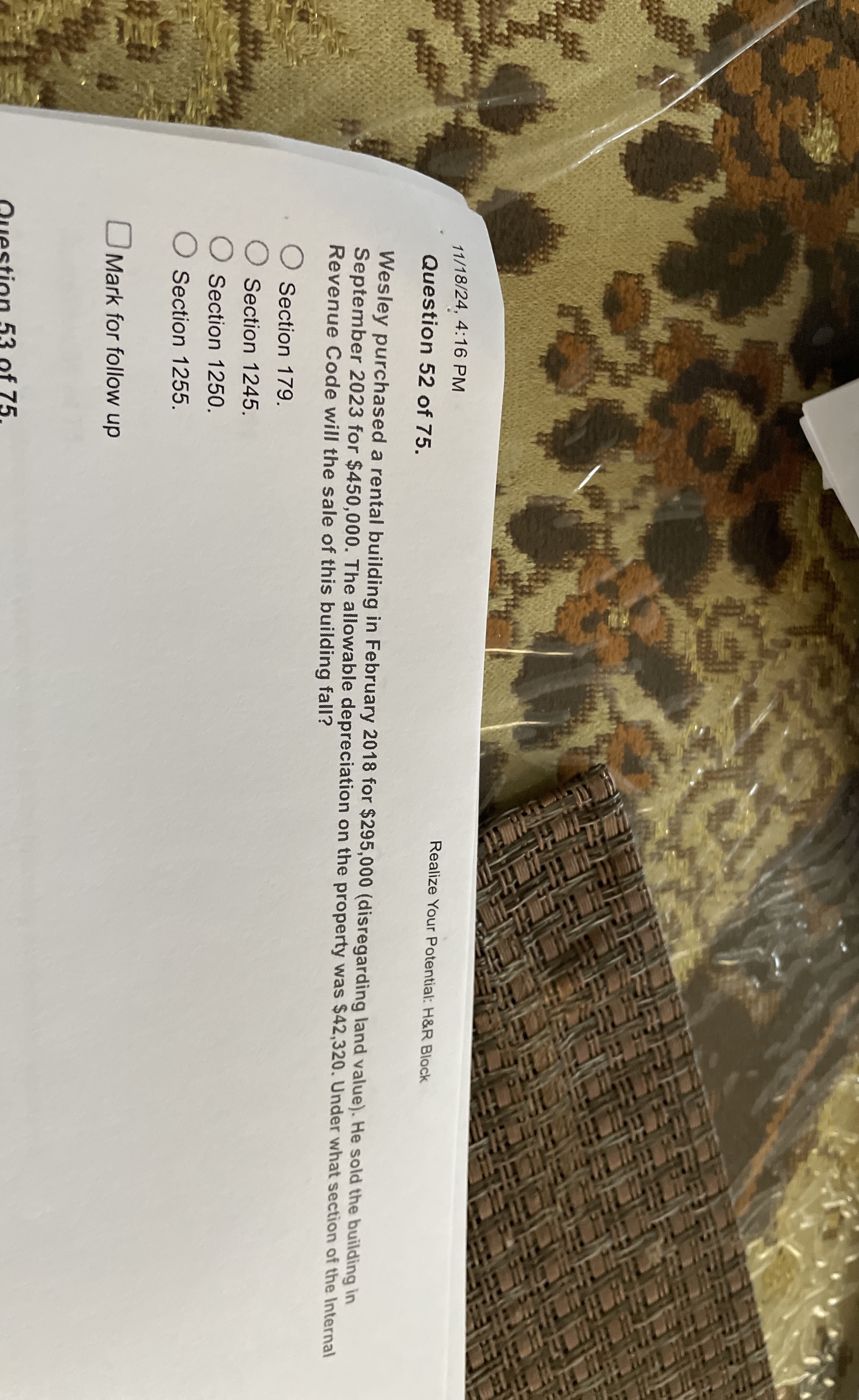

Wesley purchased a rental building in February for $disregarding land value He sold the building in September for $ The allowable depreciation on the property was $ Under what section of the Internal Revenue Code will the sale of this building fall?

Section

Section

Section

Section

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock