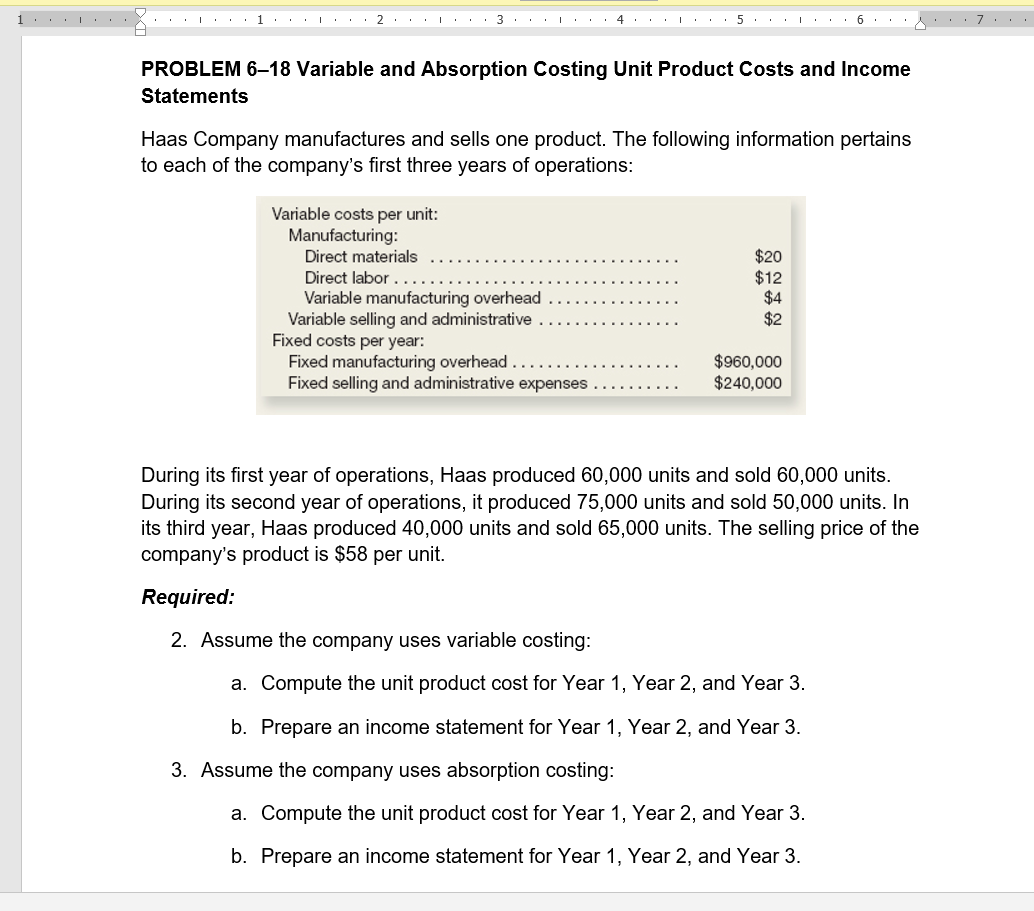

Question: 1 ... 1.... ,,,,,, 1,,,,,2,,,,,3,,,,,,4,.... 5 ::: 1.6.... 7... H PROBLEM 6-18 Variable and Absorption Costing Unit Product Costs and Income Statements Haas Company manufactures

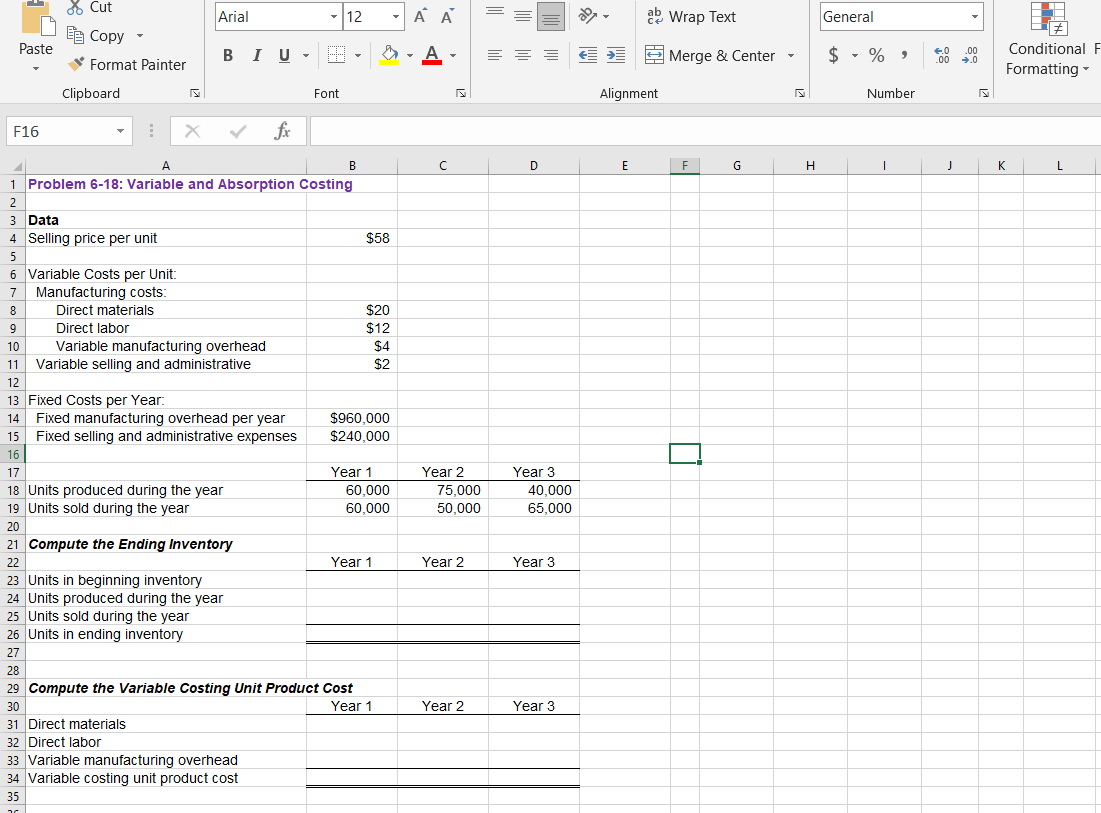

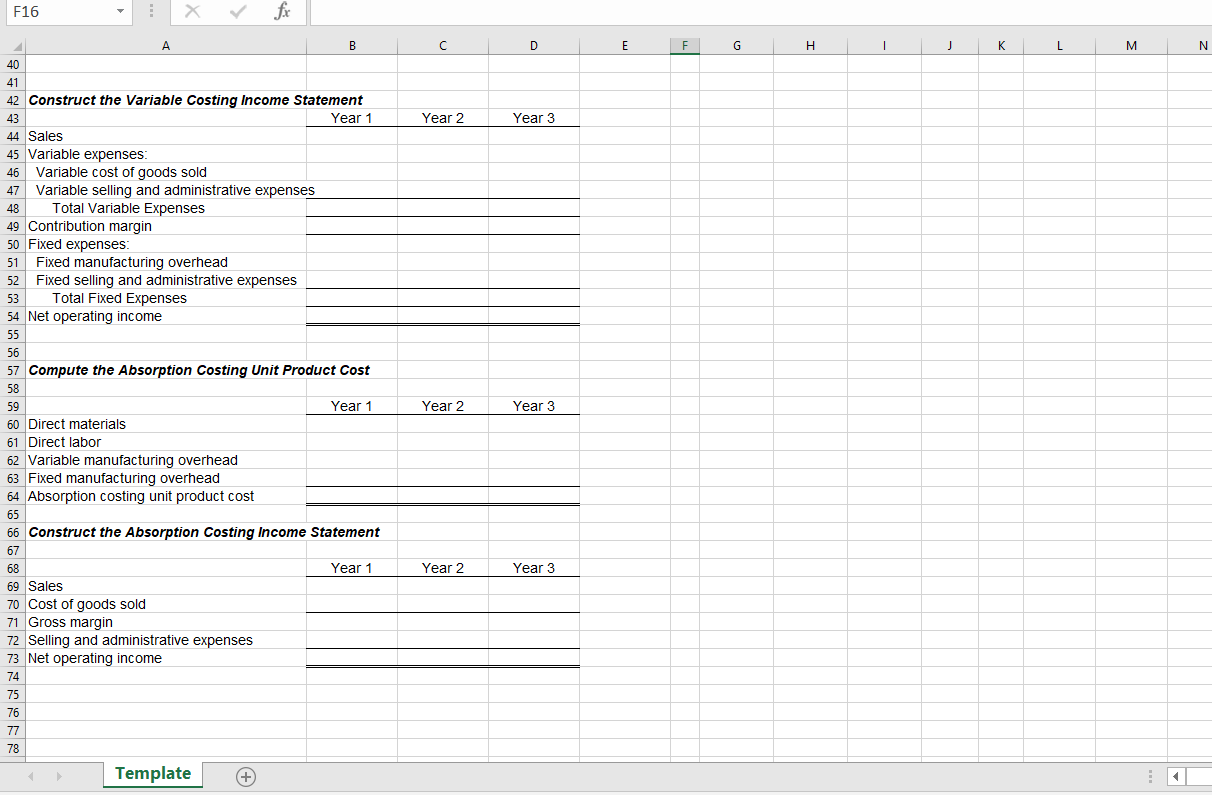

1 ... 1.... ,,,,,, 1,,,,,2,,,,,3,,,,,,4,.... 5 ::: 1.6.... 7... H PROBLEM 6-18 Variable and Absorption Costing Unit Product Costs and Income Statements Haas Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: $20 Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead .. Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses $12 $4 $2 $960,000 $240,000 During its first year of operations, Haas produced 60,000 units and sold 60,000 units. During its second year of operations, it produced 75,000 units and sold 50,000 units. In its third year, Haas produced 40,000 units and sold 65,000 units. The selling price of the company's product is $58 per unit. Required: 2. Assume the company uses variable costing: a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. 3. Assume the company uses absorption costing: a. Compute the unit product cost for Year 1, Year 2, and Year 3. b. Prepare an income statement for Year 1, Year 2, and Year 3. Arial 12 ab Wrap Text General % Cut e Copy Format Painter F Paste BIU- A Merge & Center - $ - %, 4.0 .00 .00.0 Conditional F Formatting Clipboard Font Alignment Number F16 X fc D E F H 1 J K L Ti B 1 Problem 6-18: Variable and Absorption Costing 2 3 Data 4 Selling price per unit $58 5 6 Variable Costs per Unit: 7 Manufacturing costs: 8 Direct materials $20 9 Direct labor $12 10 Variable manufacturing overhead $4 11 Variable selling and administrative $2 12 13 Fixed Costs per Year: 14 Fixed manufacturing overhead per year $960,000 15 Fixed selling and administrative expenses $240,000 16 17 Year 1 18 Units produced during the year 60,000 19 Units sold during the year 60,000 20 21 Compute the Ending Inventory 22 Year 1 23 Units in beginning inventory 24 Units produced during the year 25 Units sold during the year 26 Units in ending inventory 27 28 29 Compute the Variable Costing Unit Product Cost 30 Year 1 31 Direct materials 32 Direct labor 33 Variable manufacturing overhead 34 Variable costing unit product cost 35 Year 2 75,000 Year 3 40,000 65,000 50,000 Year 2 Year 3 Year 2 Year 3 F16 fx C D E F H 1 J J K L M N Year 2 Year 3 A B 40 41 42 Construct the Variable Costing Income Statement 43 Year 1 44 Sales 45 Variable expenses. 46 Variable cost of goods sold 47 Variable selling and administrative expenses 48 Total Variable Expenses 49 Contribution margin 50 Fixed expenses: 51 Fixed manufacturing overhead 52 Fixed selling and administrative expenses 53 Total Fixed Expenses 54 Net operating income 55 56 57 Compute the Absorption Costing Unit Product Cost 58 59 Year 1 60 Direct materials 61 Direct labor 62 Variable manufacturing overhead 63 Fixed manufacturing overhead 64 Absorption costing unit product cost 65 66 Construct the Absorption Costing Income Statement 67 68 Year 1 69 Sales 70 Cost of goods sold 71 Gross margin 72 Selling and administrative expenses 73 Net operating income 74 75 76 77 78 Template + Year 2 Year 3 Year 2 Year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts