Question: 1 . ( 1 2 points ) Driver Corporation faces an IOS schedule calling for a capital budget of ( $ 6 0

points

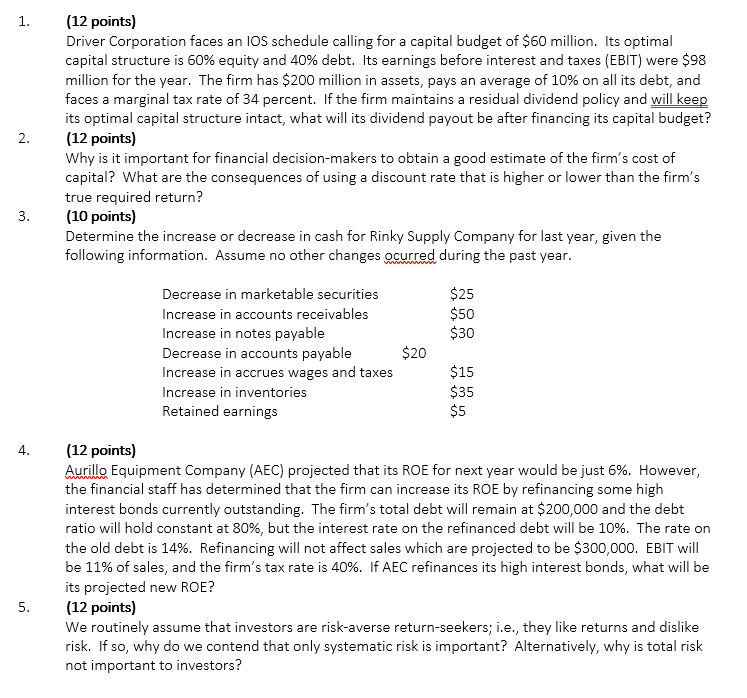

Driver Corporation faces an IOS schedule calling for a capital budget of $ million. Its optimal capital structure is equity and debt. Its earnings before interest and taxes EBIT were $ million for the year. The firm has $ million in assets, pays an average of on all its debt, and faces a marginal tax rate of percent. If the firm maintains a residual dividend policy and will keep its optimal capital structure intact, what will its dividend payout be after financing its capital budget?

points

Why is it important for financial decisionmakers to obtain a good estimate of the firm's cost of capital? What are the consequences of using a discount rate that is higher or lower than the firm's true required return?

points

Determine the increase or decrease in cash for Rinky Supply Company for last year, given the following information. Assume no other changes ocurred during the past year.

points

Aurillo Equipment Company AEC projected that its ROE for next year would be just However, the financial staff has determined that the firm can increase its ROE by refinancing some high interest bonds currently outstanding. The firm's total debt will remain at $ and the debt ratio will hold constant at but the interest rate on the refinanced debt will be The rate on the old debt is Refinancing will not affect sales which are projected to be $ EBIT will be of sales, and the firm's tax rate is If AEC refinances its high interest bonds, what will be its projected new ROE?

points

We routinely assume that investors are riskaverse returnseekers; ie they like returns and dislike risk. If so why do we contend that only systematic risk is important? Alternatively, why is total risk not important to investors?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock