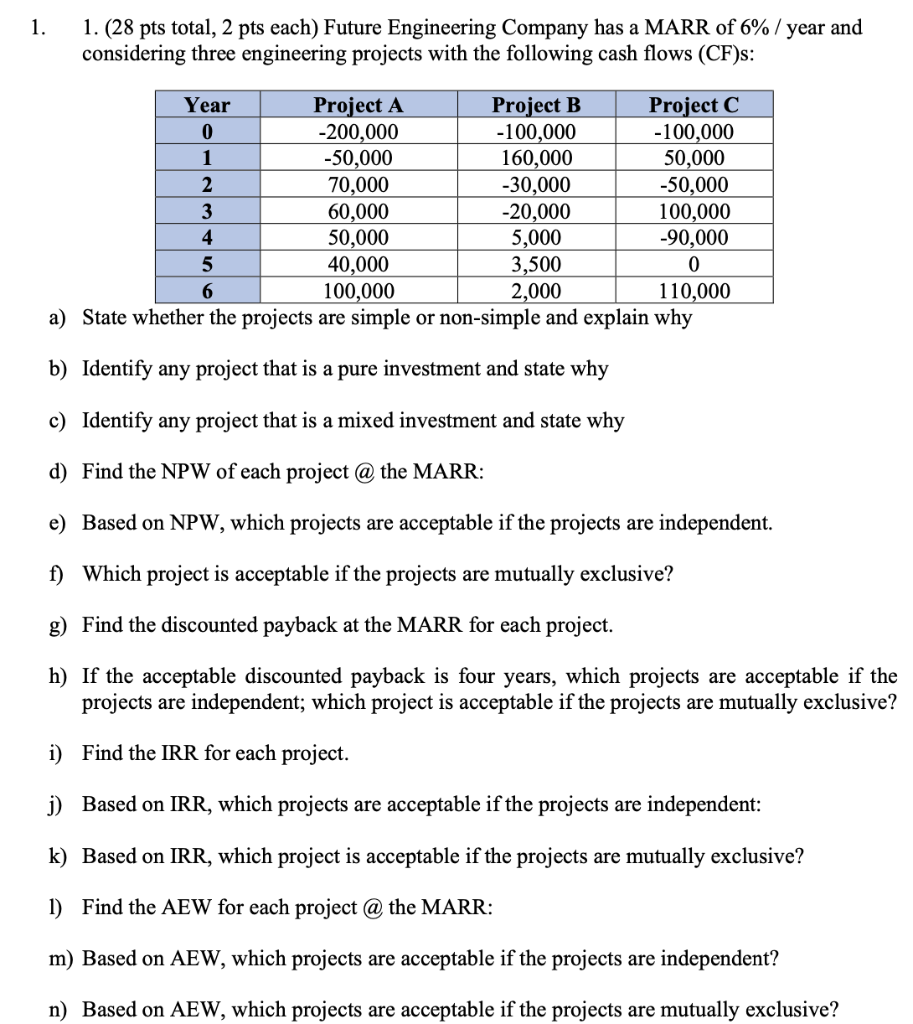

Question: 1. 1. (28 pts total, 2 pts each) Future Engineering Company has a MARR of 6% / year and considering three engineering projects with the

1. 1. (28 pts total, 2 pts each) Future Engineering Company has a MARR of 6% / year and considering three engineering projects with the following cash flows (CF)s: Year Project A Project B Project C O -200,000 -100,000 -100,000 1 -50,000 160,000 50,000 70,000 -30,000 -50,000 60,000 -20,000 100,000 50,000 5,000 -90,000 5 40,000 3,500 100,000 2,000 110,000 a) State whether the projects are simple or non-simple and explain why 0 b) Identify any project that is a pure investment and state why c) Identify any project that is a mixed investment and state why d) Find the NPW of each project @ the MARR: e) Based on NPW, which projects are acceptable if the projects are independent. f) Which project is acceptable if the projects are mutually exclusive? g) Find the discounted payback at the MARR for each project. h) If the acceptable discounted payback is four years, which projects are acceptable if the projects are independent; which project is acceptable if the projects are mutually exclusive? i) Find the IRR for each project. j) Based on IRR, which projects are acceptable if the projects are independent: k) Based on IRR, which project is acceptable if the projects are mutually exclusive? 1) Find the AEW for each project @ the MARR: m) Based on AEW, which projects are acceptable if the projects are independent? n) Based on AEW, which projects are acceptable if the projects are mutually exclusive? 1. 1. (28 pts total, 2 pts each) Future Engineering Company has a MARR of 6% / year and considering three engineering projects with the following cash flows (CF)s: Year Project A Project B Project C O -200,000 -100,000 -100,000 1 -50,000 160,000 50,000 70,000 -30,000 -50,000 60,000 -20,000 100,000 50,000 5,000 -90,000 5 40,000 3,500 100,000 2,000 110,000 a) State whether the projects are simple or non-simple and explain why 0 b) Identify any project that is a pure investment and state why c) Identify any project that is a mixed investment and state why d) Find the NPW of each project @ the MARR: e) Based on NPW, which projects are acceptable if the projects are independent. f) Which project is acceptable if the projects are mutually exclusive? g) Find the discounted payback at the MARR for each project. h) If the acceptable discounted payback is four years, which projects are acceptable if the projects are independent; which project is acceptable if the projects are mutually exclusive? i) Find the IRR for each project. j) Based on IRR, which projects are acceptable if the projects are independent: k) Based on IRR, which project is acceptable if the projects are mutually exclusive? 1) Find the AEW for each project @ the MARR: m) Based on AEW, which projects are acceptable if the projects are independent? n) Based on AEW, which projects are acceptable if the projects are mutually exclusive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts