Question: 1 / 1 4 / 2 5 , 1 2 : 3 5 PM Training detail: Curriculum Which taxpayer is required to use the general

: PM

Training detail: Curriculum

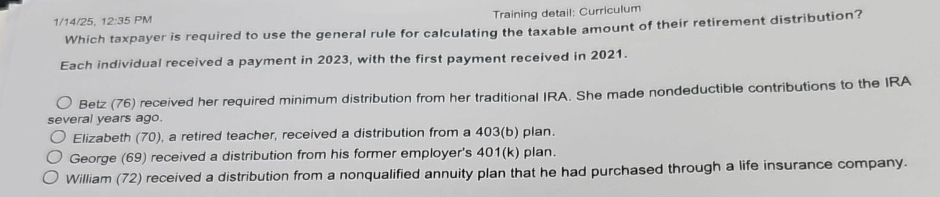

Which taxpayer is required to use the general rule for calculating the taxable amount of their retirement distribution?

Each individual received a payment in with the first payment received in

Betz received her required minimum distribution from her traditional IRA. She made nondeductible contributions to the IRA several years ago.

Elizabeth a retired teacher, received a distribution from a b plan.

George received a distribution from his former employer's k plan.

William received a distribution from a nonqualified annuity plan that he had purchased through a life insurance company.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock