Question: 1 1 : 5 4 4 LTE 6 0 Back Discussion Problems _ Ch 7 _ with sol... taxable income ) ACB after income distribution

:

LTE

Back Discussion ProblemsCh with sol...

taxable income

ACB after income distribution $ per unit

Interest income is reinvested

New units received by Martin FMV $ units

Total units owned by Martin units units

ACB$$$

ACB per unit $ units $

$ will be added to taxable income.

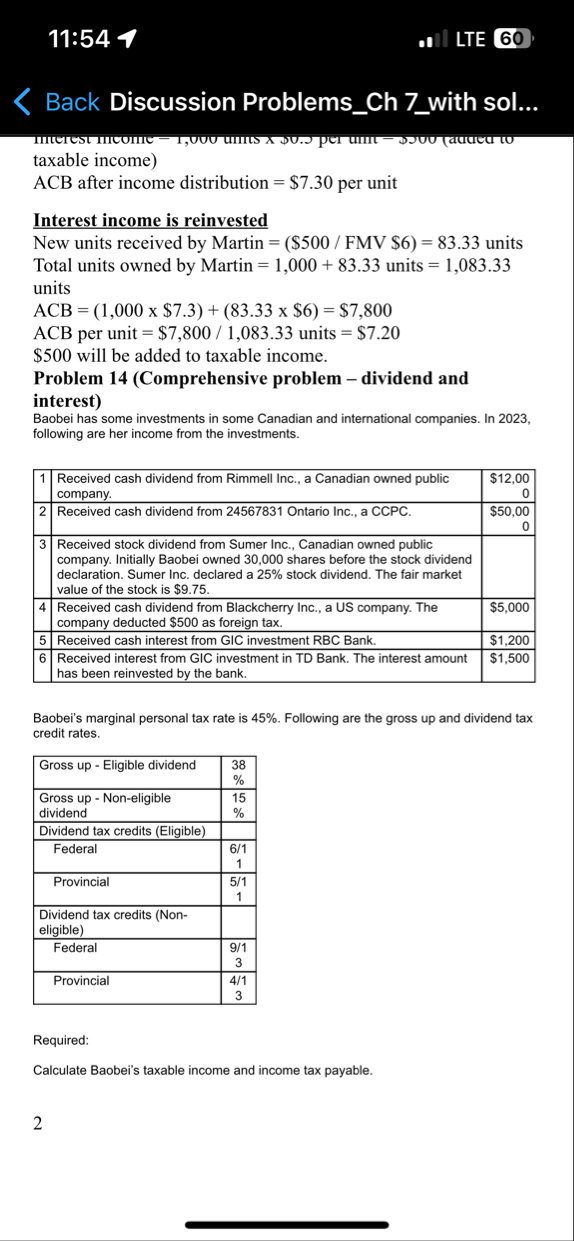

Problem Comprehensive problem dividend and interest

Baobei has some investments in some Canadian and international companies. In following are her income from the investments.

tableReceived cash dividend from Rimmell Inc., a Canadian owned public company.,table$Received cash dividend from Ontario Inc., a CCPCtable$Received stock dividend from Sumer Inc., Canadian owned public company. Initially Baobei owned shares before the stock dividend declaration. Sumer Inc. declared a stock dividend. The fair market value of the stock is $Received cash dividend from Blackcherry Inc., a US company. The company deducted $ as foreign tax.,$Received cash interest from GIC investment RBC Bank.,$Received interest from GIC investment in TD Bank. The interest amount has been reinvested by the bank.,$

Baobei's marginal personal tax rate is Following are the gross up and dividend tax credit rates.

tableGross up Eligible dividend,Gross up Noneligible dividend,Dividend tax credits EligibleFederalProvincialDividend tax credits NoneligibleFederalProvincial

Required:

Calculate Baobei's taxable income and income tax payable.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock