Question: 1 1 : 5 9 5 G Chapter 2 0 handout.docx Handout Complete in Excel On January 1 , 2 0 2 5 , Burke

:

G

Chapter handout.docx

Handout

Complete in

Excel

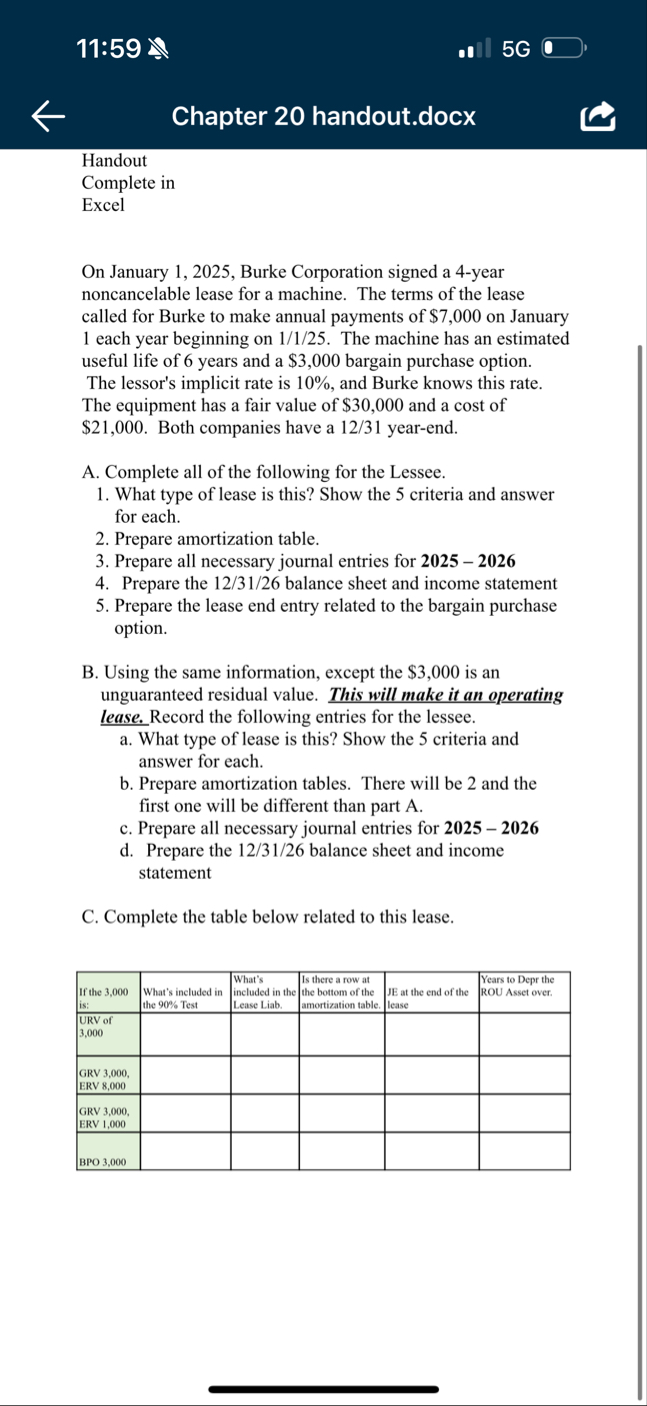

On January Burke Corporation signed a year noncancelable lease for a machine. The terms of the lease called for Burke to make annual payments of $ on January each year beginning on The machine has an estimated useful life of years and a $ bargain purchase option.

The lessor's implicit rate is and Burke knows this rate. The equipment has a fair value of $ and a cost of $ Both companies have a yearend.

A Complete all of the following for the Lessee.

What type of lease is this? Show the criteria and answer for each.

Prepare amortization table.

Prepare all necessary journal entries for

Prepare the balance sheet and income statement

Prepare the lease end entry related to the bargain purchase option.

B Using the same information, except the $ is an unguaranteed residual value. This will make it an operating lease. Record the following entries for the lessee.

a What type of lease is this? Show the criteria and answer for each.

b Prepare amortization tables. There will be and the first one will be different than part A

c Prepare all necessary journal entries for

d Prepare the balance sheet and income statement

C Complete the table below related to this lease.

tableIf the is:What's included in the Test,What's included in the Lease Liab.,Is there a row at the bottom of the amortization table.,JE at the end of the lease,Years to Depr the ROU Asset over.URV of GRV ERV GRV ERV BPO

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock