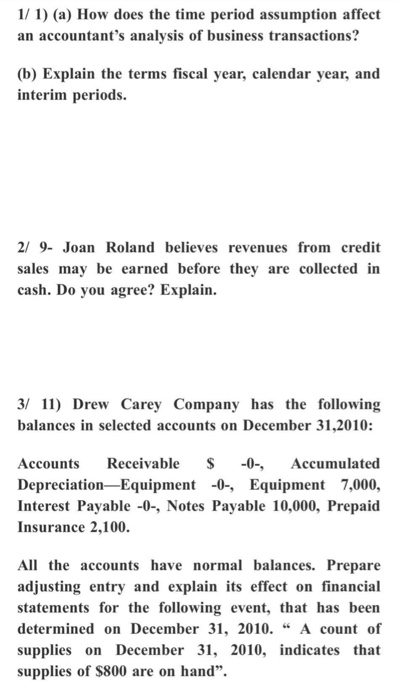

Question: 1/ 1) (a) How does the time period assumption affect an accountant's analysis of business transactions? (b) Explain the terms fiscal year, calendar year, and

1/ 1) (a) How does the time period assumption affect an accountant's analysis of business transactions? (b) Explain the terms fiscal year, calendar year, and interim periods. 2/ 9- Joan Roland believes revenues from credit sales may be earned before they are collected in cash. Do you agree? Explain. 3/ 11) Drew Carey Company has the following balances in selected accounts on December 31,2010: Accounts Receivable $ Accumulated Depreciation Equipment -0-, Equipment 7,000, Interest Payable - O-, Notes Payable 10,000, Prepaid Insurance 2,100. All the accounts have normal balances. Prepare adjusting entry and explain its effect on financial statements for the following event, that has been determined on December 31, 2010. A count of supplies on December 31, 2010, indicates that supplies of $800 are on hand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts