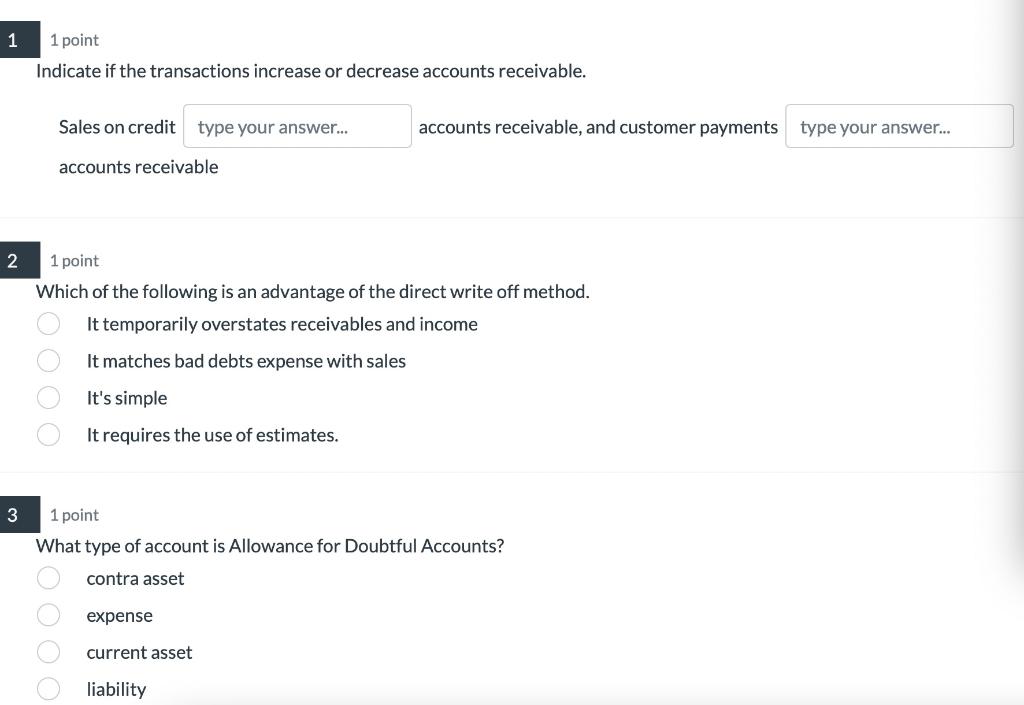

Question: 1 1 point Indicate if the transactions increase or decrease accounts receivable. Sales on credit type your answer... accounts receivable, and customer payments type your

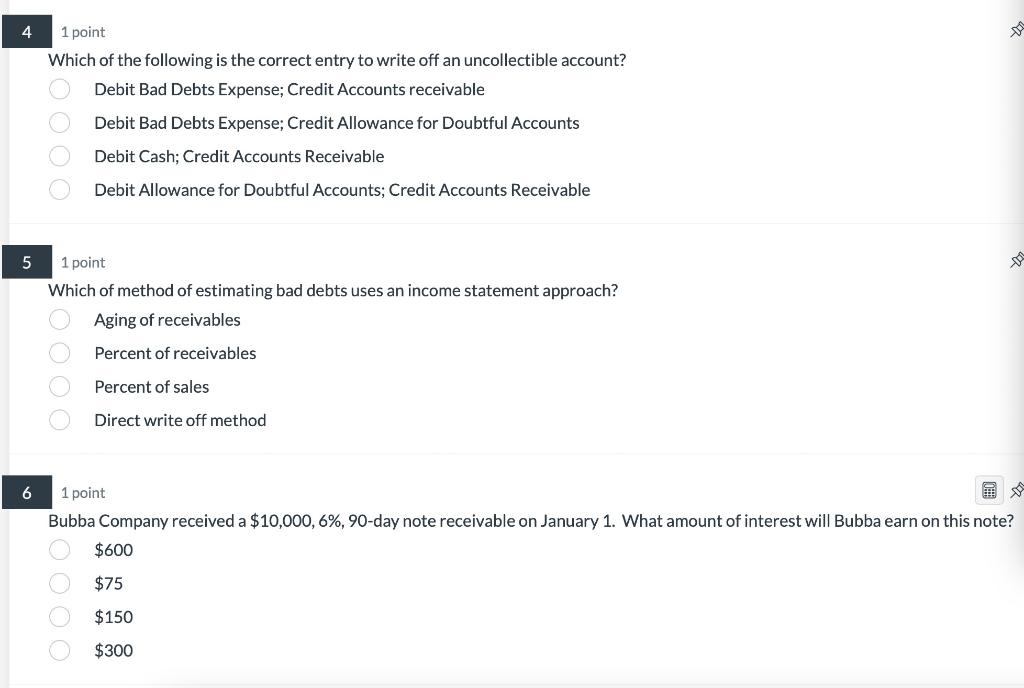

1 1 point Indicate if the transactions increase or decrease accounts receivable. Sales on credit type your answer... accounts receivable, and customer payments type your answer... accounts receivable 2 1 point Which of the following is an advantage of the direct write off method. It temporarily overstates receivables and income BOOOO It matches bad debts expense with sales It's simple It requires the use of estimates. 3 1 point What type of account is Allowance for Doubtful Accounts? contra asset O O O O expense current asset liability 4 1 point Which of the following is the correct entry to write off an uncollectible account? Debit Bad Debts Expense; Credit Accounts receivable Debit Bad Debts Expense; Credit Allowance for Doubtful Accounts OOOO Debit Cash; Credit Accounts Receivable Debit Allowance for Doubtful Accounts; Credit Accounts Receivable 5 1 point Which of method of estimating bad debts uses an income statement approach? Aging of receivables Percent of receivables OOOO Percent of sales Direct write off method 6 1 point Bubba Company received a $10,000, 6%, 90-day note receivable on January 1. What amount of interest will Bubba earn on this note? $600 $75 $150 $300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts