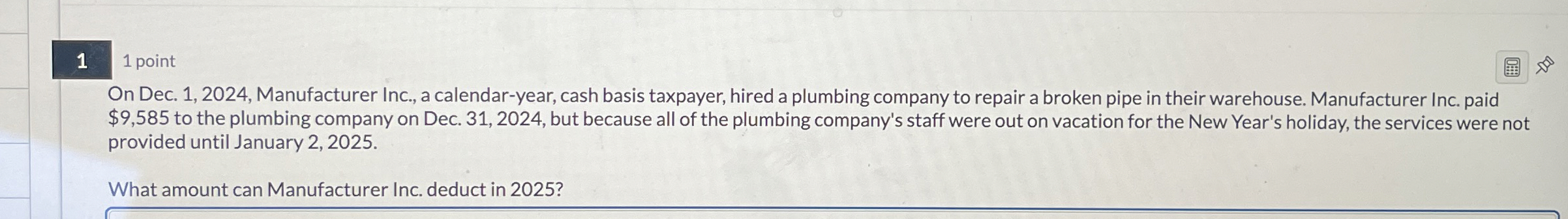

Question: 1 1 point On Dec. 1 , 2 0 2 4 , Manufacturer Inc., a calendar - year, cash basis taxpayer, hired a plumbing company

point

On Dec. Manufacturer Inc., a calendaryear, cash basis taxpayer, hired a plumbing company to repair a broken pipe in their warehouse. Manufacturer Inc. paid

$ to the plumbing company on Dec. but because all of the plumbing company's staff were out on vacation for the New Year's holiday, the services were not

provided until January

What amount can Manufacturer Inc. deduct in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock