Question: 1 1 Question 1 (20 points) The returns on assets in an economy depend on the realization of two risk factors, denoted by 11 and

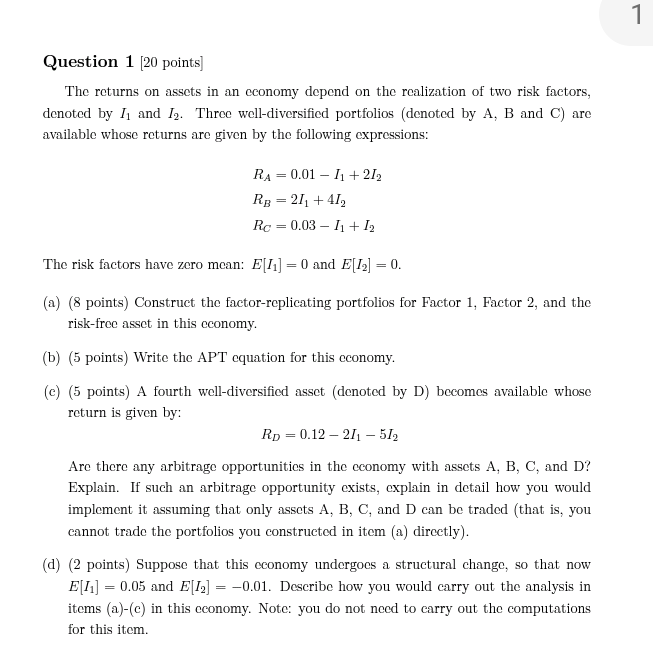

1 1 Question 1 (20 points) The returns on assets in an economy depend on the realization of two risk factors, denoted by 11 and 12. Three well-diversified portfolios (denoted by A, B and C) are available whose returns are given by the following expressions: RA = 0.01 - 1+ 2) RB = 211 +41, Rc = 0.03 - 11 + 12 The risk factors have zero mcan: E[11] = 0 and E[12] = 0. (a) (8 points) Construct the factor-replicating portfolios for Factor 1, Factor 2, and the risk-free asset in this economy. (b) (5 points) Write the APT cquation for this economy. (c) (5 points) A fourth well-diversified asset (denoted by D) becomes available whose return is given by: Rp = 0.12 - 211 51, Are there any arbitrage opportunities in the economy with assets A, B, C, and D? Explain. If such an arbitrage opportunity exists, explain in detail how you would implement it assuming that only assets A, B, C, and D can be traded (that is, you cannot trade the portfolios you constructed in item (a) directly). (d) (2 points) Suppose that this economy undergoes a structural change, so that now E[11] = 0.05 and E[12] = -0.01. Describe how you would carry out the analysis in items (a)-(e) in this cconomy. Note: you do not need to carry out the computations for this item 1 1 Question 1 (20 points) The returns on assets in an economy depend on the realization of two risk factors, denoted by 11 and 12. Three well-diversified portfolios (denoted by A, B and C) are available whose returns are given by the following expressions: RA = 0.01 - 1+ 2) RB = 211 +41, Rc = 0.03 - 11 + 12 The risk factors have zero mcan: E[11] = 0 and E[12] = 0. (a) (8 points) Construct the factor-replicating portfolios for Factor 1, Factor 2, and the risk-free asset in this economy. (b) (5 points) Write the APT cquation for this economy. (c) (5 points) A fourth well-diversified asset (denoted by D) becomes available whose return is given by: Rp = 0.12 - 211 51, Are there any arbitrage opportunities in the economy with assets A, B, C, and D? Explain. If such an arbitrage opportunity exists, explain in detail how you would implement it assuming that only assets A, B, C, and D can be traded (that is, you cannot trade the portfolios you constructed in item (a) directly). (d) (2 points) Suppose that this economy undergoes a structural change, so that now E[11] = 0.05 and E[12] = -0.01. Describe how you would carry out the analysis in items (a)-(e) in this cconomy. Note: you do not need to carry out the computations for this item

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts