Question: 1 . 1 Task 1 : Credit Card Routing for Online Purchase via Predictive Modelling Case description: This is your first day as a data

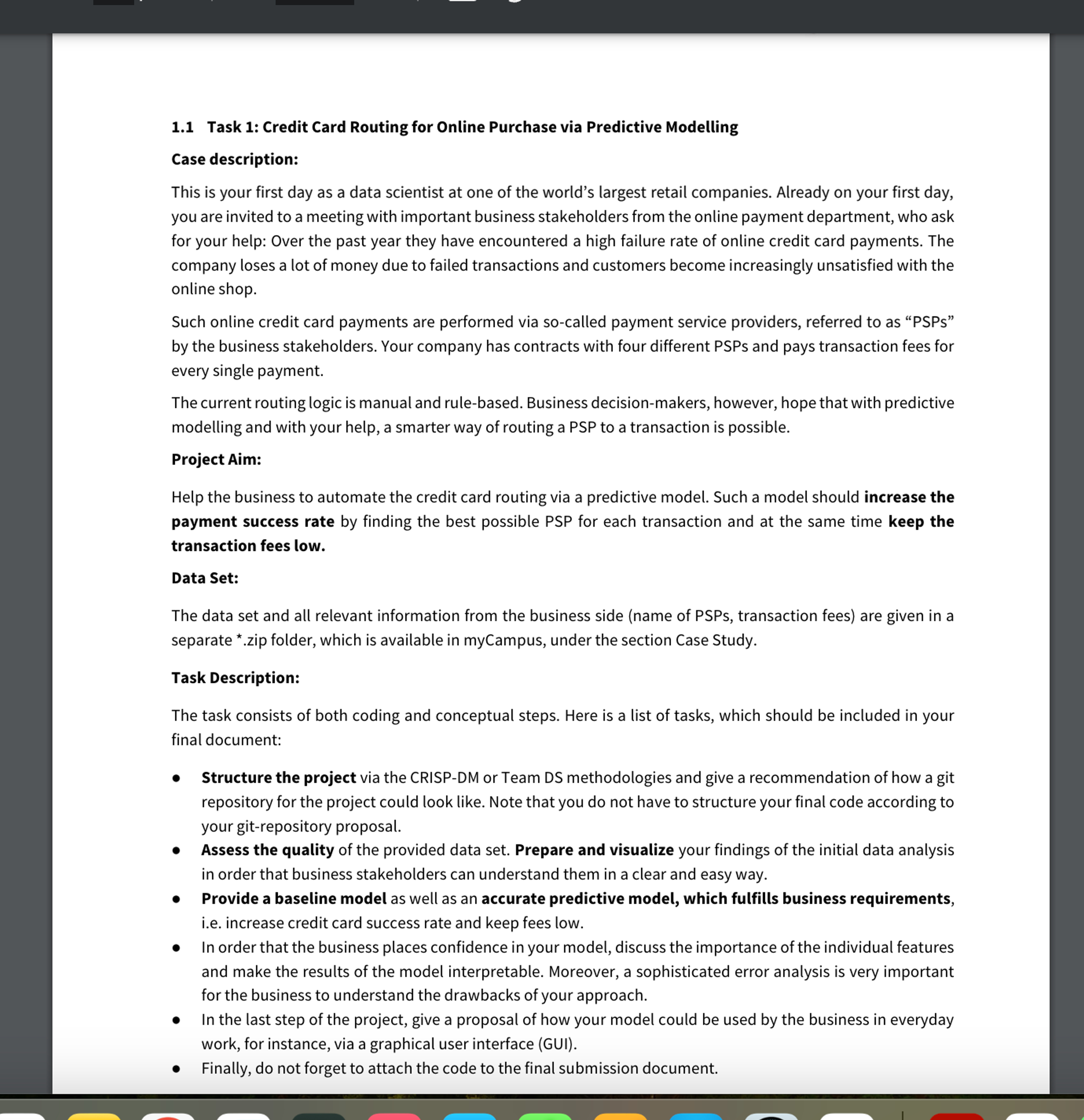

Task : Credit Card Routing for Online Purchase via Predictive Modelling

Case description:

This is your first day as a data scientist at one of the world's largest retail companies. Already on your first day,

you are invited to a meeting with important business stakeholders from the online payment department, who ask

for your help: Over the past year they have encountered a high failure rate of online credit card payments. The

company loses a lot of money due to failed transactions and customers become increasingly unsatisfied with the

online shop.

Such online credit card payments are performed via socalled payment service providers, referred to as PSPs

by the business stakeholders. Your company has contracts with four different PSPs and pays transaction fees for

every single payment.

The current routing logic is manual and rulebased. Business decisionmakers, however, hope that with predictive

modelling and with your help, a smarter way of routing a PSP to a transaction is possible.

Project Aim:

Help the business to automate the credit card routing via a predictive model. Such a model should increase the

payment success rate by finding the best possible PSP for each transaction and at the same time keep the

transaction fees low.

Data Set:

The data set and all relevant information from the business side name of PSPs transaction fees are given in a

separate zip folder, which is available in myCampus, under the section Case Study.

Task Description:

The task consists of both coding and conceptual steps. Here is a list of tasks, which should be included in your

final document:

Structure the project via the CRISPDM or Team DS methodologies and give a recommendation of how a git

repository for the project could look like. Note that you do not have to structure your final code according to

your gitrepository proposal.

Assess the quality of the provided data set. Prepare and visualize your findings of the initial data analysis

in order that business stakeholders can understand them in a clear and easy way.

Provide a baseline model as well as an accurate predictive model, which fulfills business requirements,

ie increase credit card success rate and keep fees low.

In order that the business places confidence in your model, discuss the importance of the individual features

and make the results of the model interpretable. Moreover, a sophisticated error analysis is very important

for the business to understand the drawbacks of your approach.

In the last step of the project, give a proposal of how your model could be used by the business in everyday

work, for instance, via a graphical user interface GUI

Finally, do not forget to attach the code to the final submission document.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock