Question: 1 1. Why would the difference between the geometric and arithmetic means be greater in the case of investing in a growth stocks' fund when

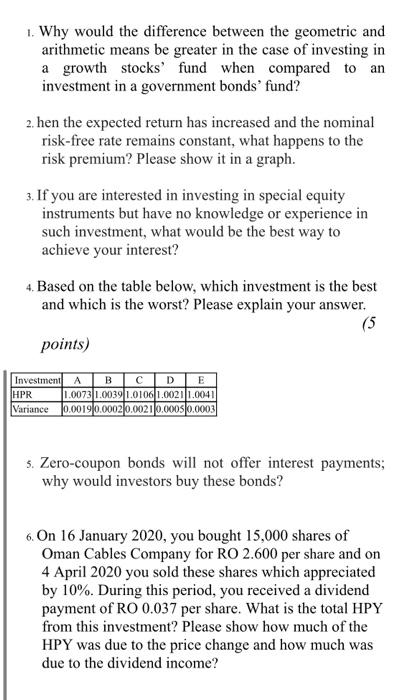

1 1. Why would the difference between the geometric and arithmetic means be greater in the case of investing in a growth stocks' fund when compared to an investment in a government bonds' fund? 2. hen the expected return has increased and the nominal risk-free rate remains constant, what happens to the risk premium? Please show it in a graph. 3. If you are interested in investing in special equity instruments but have no knowledge or experience in such investment, what would be the best way to achieve your interest? 4. Based on the table below, which investment is the best and which is the worst? Please explain your answer. (5 points) Investment A BCD E HPR 1.0073 1.0039 1.01061.002110041 Variance 0.00190.0002 0.00210.0005 0.0003 5. Zero-coupon bonds will not offer interest payments; why would investors buy these bonds? 6. On 16 January 2020, you bought 15,000 shares of Oman Cables Company for RO 2.600 per share and on 4 April 2020 you sold these shares which appreciated by 10%. During this period, you received a dividend payment of RO 0.037 per share. What is the total HPY from this investment? Please show how much of the HPY was due to the price change and how much was due to the dividend income? 1 1. Why would the difference between the geometric and arithmetic means be greater in the case of investing in a growth stocks' fund when compared to an investment in a government bonds' fund? 2. hen the expected return has increased and the nominal risk-free rate remains constant, what happens to the risk premium? Please show it in a graph. 3. If you are interested in investing in special equity instruments but have no knowledge or experience in such investment, what would be the best way to achieve your interest? 4. Based on the table below, which investment is the best and which is the worst? Please explain your answer. (5 points) Investment A BCD E HPR 1.0073 1.0039 1.01061.002110041 Variance 0.00190.0002 0.00210.0005 0.0003 5. Zero-coupon bonds will not offer interest payments; why would investors buy these bonds? 6. On 16 January 2020, you bought 15,000 shares of Oman Cables Company for RO 2.600 per share and on 4 April 2020 you sold these shares which appreciated by 10%. During this period, you received a dividend payment of RO 0.037 per share. What is the total HPY from this investment? Please show how much of the HPY was due to the price change and how much was due to the dividend income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts