Question: 1) 10 points: Access the FASB's Accounting Standards Codification System: Identify where each of the following accounting topics would be located. Use the following

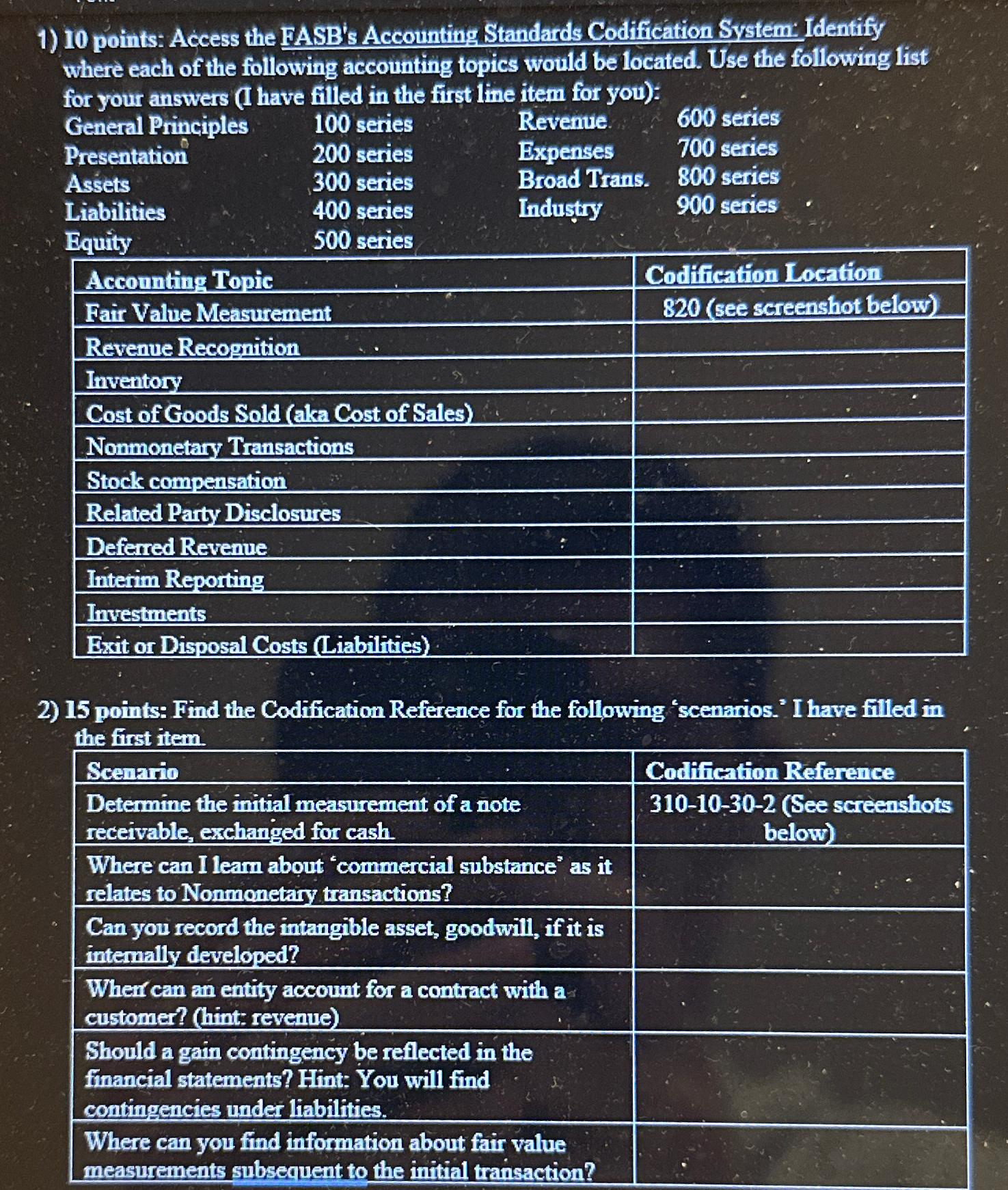

1) 10 points: Access the FASB's Accounting Standards Codification System: Identify where each of the following accounting topics would be located. Use the following list for your answers (I have filled in the first line item for you): General Principles Presentation Assets Liabilities Equity 100 series 200 series Revenue. Expenses 600 series 700 series 300 series Broad Trans. 800 series 400 series Industry 900 series 500 series Codification Location Accounting Topic Fair Value Measurement Revenue Recognition Inventory Cost of Goods Sold (aka Cost of Sales) Nonmonetary Transactions Stock compensation Related Party Disclosures Deferred Revenue 820 (see screenshot below) Interim Reporting Investments Exit or Disposal Costs (Liabilities) 2) 15 points: Find the Codification Reference for the following 'scenarios.' I have filled in the first item. Scenario Determine the initial measurement of a note receivable, exchanged for cash. Where can I learn about 'commercial substance* as it Codification Reference 310-10-30-2 (See screenshots below) relates to Nonmonetary transactions? Can you record the intangible asset, goodwill, if it is internally developed? When can an entity account for a contract with a customer? (hint: revenue) Should a gain contingency be reflected in the financial statements? Hint: You will find contingencies under liabilities. Where can you find information about fair value measurements subsequent to the initial transaction?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts