Question: 1. (10 points) Answer two questions on Stock C using the following information. The current stock price (Po): $80 per share The average growth rate

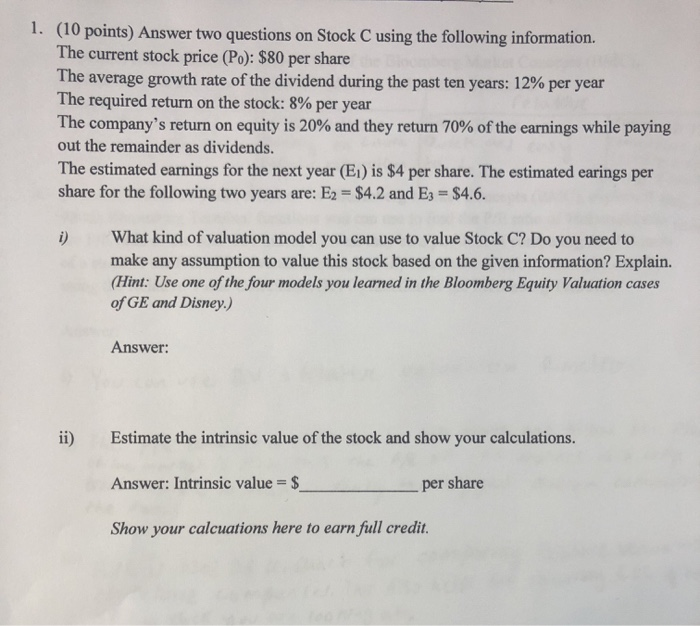

1. (10 points) Answer two questions on Stock C using the following information. The current stock price (Po): $80 per share The average growth rate of the dividend during the past ten years: 12% per year The required return on the stock: 8% per year The company's return on equity is 20% and they return 70% of the earnings while paying out the remainder as dividends. The estimated earnings for the next year (Ei) is $4 per share. The estimated earings per share for the following two years are: E2 = $4.2 and E3 = $4.6. i) What kind of valuation model you can use to value Stock C? Do you need to make any assumption to value this stock based on the given information? Explain. (Hint: Use one of the four models you learned in the Bloomberg Equity Valuation cases of GE and Disney.) Answer: ii) Es mate the intrinsic value of the stock and show your calculations. Answer: Intrinsic value = $ per share Show your calcuations here to earn full credit. 1. (10 points) Answer two questions on Stock C using the following information. The current stock price (Po): $80 per share The average growth rate of the dividend during the past ten years: 12% per year The required return on the stock: 8% per year The company's return on equity is 20% and they return 70% of the earnings while paying out the remainder as dividends. The estimated earnings for the next year (Ei) is $4 per share. The estimated earings per share for the following two years are: E2 = $4.2 and E3 = $4.6. i) What kind of valuation model you can use to value Stock C? Do you need to make any assumption to value this stock based on the given information? Explain. (Hint: Use one of the four models you learned in the Bloomberg Equity Valuation cases of GE and Disney.) Answer: ii) Es mate the intrinsic value of the stock and show your calculations. Answer: Intrinsic value = $ per share Show your calcuations here to earn full credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts