Question: 1. (10 Points) Mayday Pilot Training Enterprises Inc. Pension Plan offers an annual retirement pension of 2% of Final Salary (FAS) for each year of

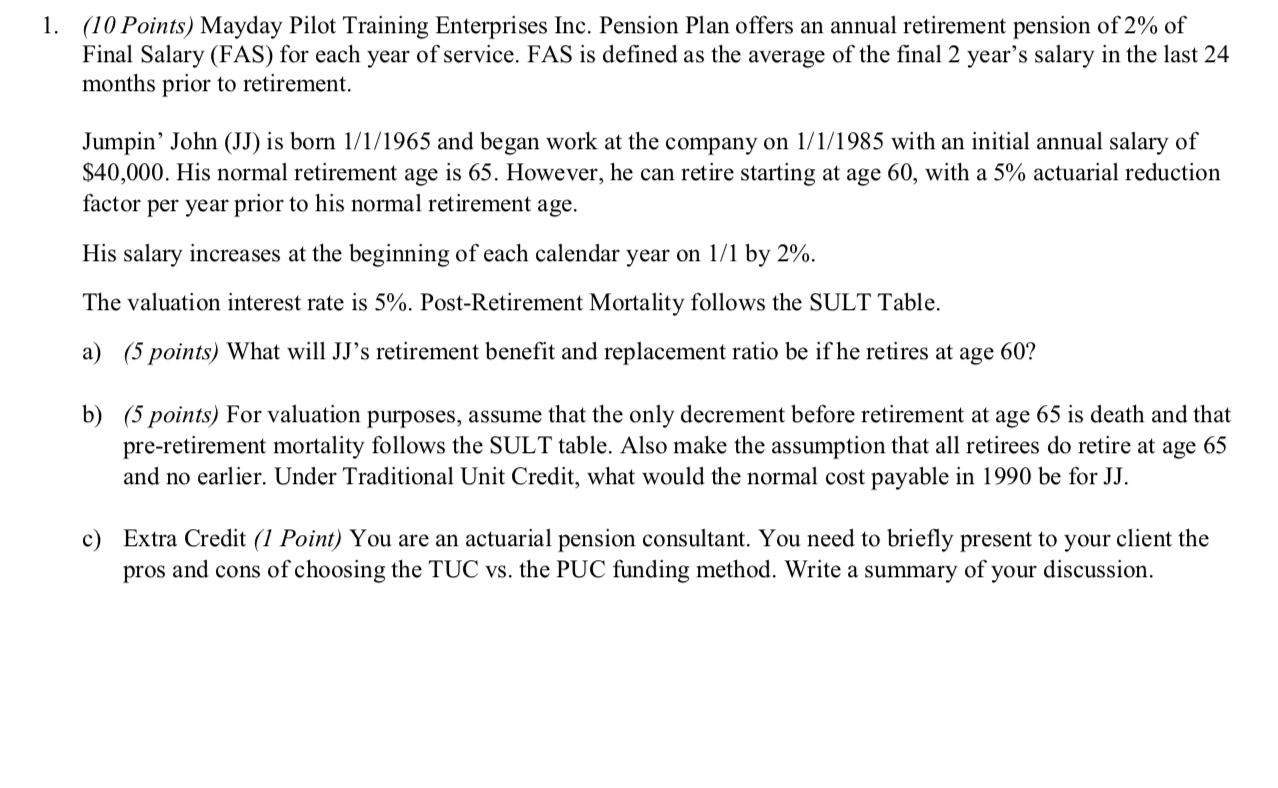

1. (10 Points) Mayday Pilot Training Enterprises Inc. Pension Plan offers an annual retirement pension of 2% of Final Salary (FAS) for each year of service. FAS is defined as the average of the final 2 year's salary in the last 24 months prior to retirement. Jumpin' John (JJ) is born 1/1/1965 and began work at the company on 1/1/1985 with an initial annual salary of $40,000. His normal retirement age is 65. However, he can retire starting at age 60, with a 5% actuarial reduction factor per year prior to his normal retirement age. His salary increases at the beginning of each calendar year on 1/1 by 2%. The valuation interest rate is 5%. Post-Retirement Mortality follows the SULT Table. a) (5 points) What will JJ's retirement benefit and replacement ratio be if he retires at age 60? b) (5 points) For valuation purposes, assume that the only decrement before retirement at age 65 is death and that pre-retirement mortality follows the SULT table. Also make the assumption that all retirees do retire at age 65 and no earlier. Under Traditional Unit Credit, what would the normal cost payable in 1990 be for JJ. c) Extra Credit (1 Point) You are an actuarial pension consultant. You need to briefly present to your client the pros and cons of choosing the TUC vs. the PUC funding method. Write a summary of your discussion. 1. (10 Points) Mayday Pilot Training Enterprises Inc. Pension Plan offers an annual retirement pension of 2% of Final Salary (FAS) for each year of service. FAS is defined as the average of the final 2 year's salary in the last 24 months prior to retirement. Jumpin' John (JJ) is born 1/1/1965 and began work at the company on 1/1/1985 with an initial annual salary of $40,000. His normal retirement age is 65. However, he can retire starting at age 60, with a 5% actuarial reduction factor per year prior to his normal retirement age. His salary increases at the beginning of each calendar year on 1/1 by 2%. The valuation interest rate is 5%. Post-Retirement Mortality follows the SULT Table. a) (5 points) What will JJ's retirement benefit and replacement ratio be if he retires at age 60? b) (5 points) For valuation purposes, assume that the only decrement before retirement at age 65 is death and that pre-retirement mortality follows the SULT table. Also make the assumption that all retirees do retire at age 65 and no earlier. Under Traditional Unit Credit, what would the normal cost payable in 1990 be for JJ. c) Extra Credit (1 Point) You are an actuarial pension consultant. You need to briefly present to your client the pros and cons of choosing the TUC vs. the PUC funding method. Write a summary of your discussion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts