Question: 1) 10 points. Set up a cash flow table for each year (Years 0 - 5). You'll need to find operating income (i.e. the cost

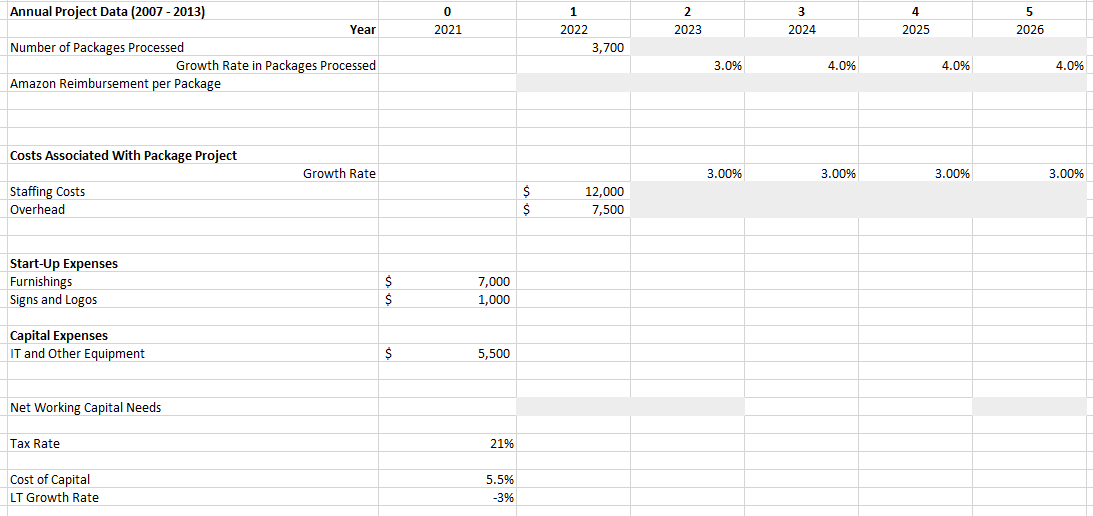

1) 10 points. Set up a cash flow table for each year (Years 0 - 5). You'll need to find operating income (i.e. the cost savings from the project), other expenses, pre-tax income, taxes, and after-tax income. You'll also need to then to make the other necessary adjustments to get to total cash flows for the project.

1) 10 points. Set up a cash flow table for each year (Years 0 - 5). You'll need to find operating income (i.e. the cost savings from the project), other expenses, pre-tax income, taxes, and after-tax income. You'll also need to then to make the other necessary adjustments to get to total cash flows for the project.

At the end of the project, assume a horizon value where you treat the Year 5 cash flow as a growing perpetuity, but with a growth rate of -3%. Yeah, that's really a negative 3%!

2) 5 points. Find the NPV and IRR of this project.

3) 5 points. Comment on the cost of capital used. How does it compare to their current WACC of 7.81%? Why might it be different? Should it be different?

4) 5 points. We'll finish with some sensitivity analysis. Vary the growth rate in the costs and the cost of capital, using sensible units of change, to show how NPV changes. Use a data table.

0 2021 1 2022 3,700 2 2023 3 2024 4 2025 Annual Project Data (2007-2013) Year Number of Packages Processed Growth Rate in Packages Processed Amazon Reimbursement per Package 5 2026 3.0% 4.0% 4.0% 4.0% Costs Associated with Package Project Growth Rate 3.00% 3.00% 3.00% 3.00% Staffing Costs Overhead $ $ 12,000 7,500 Start-Up Expenses Furnishings Signs and Logos $ S 7,000 1,000 Capital Expenses IT and Other Equipment $ 5,500 Net Working Capital Needs Tax Rate 21% Cost of Capital LT Growth Rate 5.5% -3% 0 2021 1 2022 3,700 2 2023 3 2024 4 2025 Annual Project Data (2007-2013) Year Number of Packages Processed Growth Rate in Packages Processed Amazon Reimbursement per Package 5 2026 3.0% 4.0% 4.0% 4.0% Costs Associated with Package Project Growth Rate 3.00% 3.00% 3.00% 3.00% Staffing Costs Overhead $ $ 12,000 7,500 Start-Up Expenses Furnishings Signs and Logos $ S 7,000 1,000 Capital Expenses IT and Other Equipment $ 5,500 Net Working Capital Needs Tax Rate 21% Cost of Capital LT Growth Rate 5.5% -3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts