Question: 1. 10 years ago, a borrower took out a fully amortizing 30-year fixed rate mortgage for $640,000. The loan had a 3.75% interest rate. Since

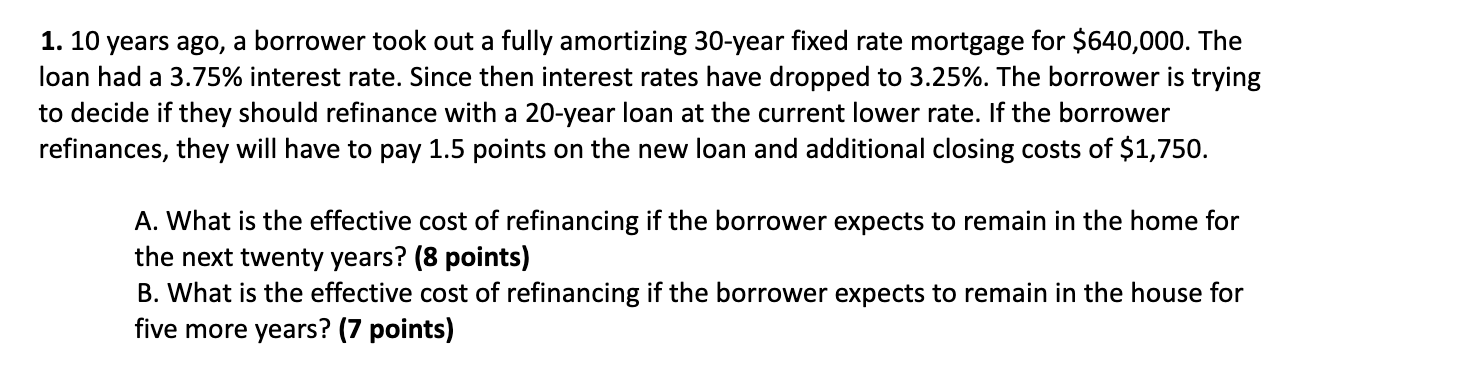

1. 10 years ago, a borrower took out a fully amortizing 30-year fixed rate mortgage for $640,000. The loan had a 3.75% interest rate. Since then interest rates have dropped to 3.25%. The borrower is trying to decide if they should refinance with a 20-year loan at the current lower rate. If the borrower refinances, they will have to pay 1.5 points on the new loan and additional closing costs of $1,750. A. What is the effective cost of refinancing if the borrower expects to remain in the home for the next twenty years? (8 points) B. What is the effective cost of refinancing if the borrower expects to remain in the house for five more years? (7 points) 1. 10 years ago, a borrower took out a fully amortizing 30-year fixed rate mortgage for $640,000. The loan had a 3.75% interest rate. Since then interest rates have dropped to 3.25%. The borrower is trying to decide if they should refinance with a 20-year loan at the current lower rate. If the borrower refinances, they will have to pay 1.5 points on the new loan and additional closing costs of $1,750. A. What is the effective cost of refinancing if the borrower expects to remain in the home for the next twenty years? (8 points) B. What is the effective cost of refinancing if the borrower expects to remain in the house for five more years? (7 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts