Question: 1. (12 points) Bond Supply and Demand: Please explain how the demand and/or supply of bonds are affected in the following scenarios. Use the demand

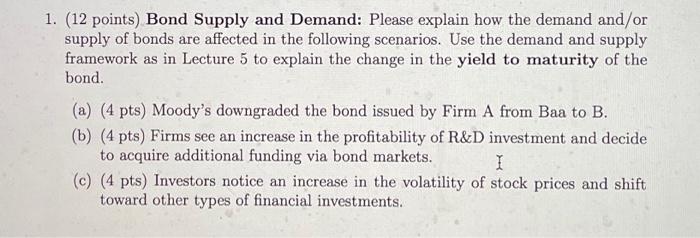

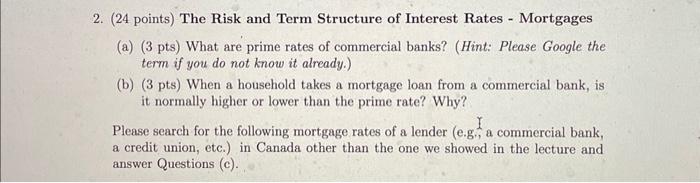

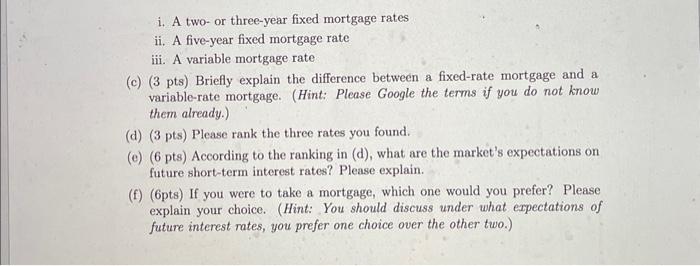

1. (12 points) Bond Supply and Demand: Please explain how the demand and/or supply of bonds are affected in the following scenarios. Use the demand and supply framework as in Lecture 5 to explain the change in the yield to maturity of the bond. (a) (4 pts) Moody's downgraded the bond issued by Firm A from Baa to B. (b) (4 pts) Firms see an increase in the profitability of R\&D investment and decide to acquire additional funding via bond markets. (c) (4 pts) Investors notice an increase in the volatility of stock prices and shift toward other types of financial investments. 2. (24 points) The Risk and Term Structure of Interest Rates - Mortgages (a) (3 pts) What are prime rates of commercial banks? (Hint: Please Google the term if you do not know it already.) (b) ( 3pts) When a household takes a mortgage loan from a commercial bank, is it normally higher or lower than the prime rate? Why? Please search for the following mortgage rates of a lender (e.g, a commercial bank, a credit union, etc.) in Canada other than the one we showed in the lecture and answer Questions (c). i. A two-or three-year fixed mortgage rates ii. A five-year fixed mortgage rate iii. A variable mortgage rate (c) (3 pts) Briefly explain the difference between a fixed-rate mortgage and a variable-rate mortgage. (Hint: Please Google the terms if you do not know them already.) (d) (3pts) Please rank the three rates you found. (e) (6 pts) According to the ranking in (d), what are the market's expectations on future short-term interest rates? Please explain. (f) (6pts) If you were to take a mortgage, which one would you prefer? Please explain your choice. (Hint: You should discuss under what expectations of future interest rates, you prefer one choice over the other two.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts