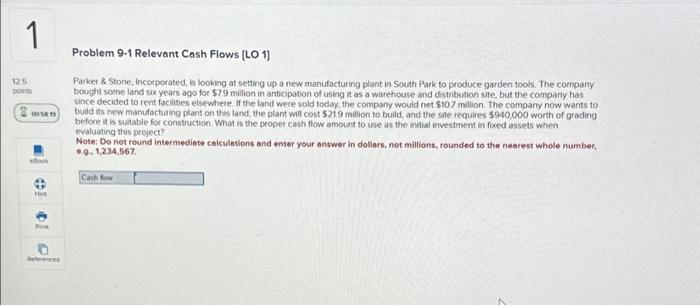

Question: 1 12.5 points 00:58:19 eBook Hint Print References Problem 9-1 Relevant Cash Flows [LO 1] Parker & Stone, Incorporated, is looking at setting up a

Parker \& Stone, incorporated, is looking at setting up a new manufacturing plant in South Park to produce garden qools. The company bought some land six years apo for $79 milion in anticipation of using it as a warehcurse and tistrbution site, but the company has since decided to rent facilies elsewhere. If the land were sold today, the company would net $107 million. The company now wants to build its new manufactiaing plant on this land, the plant wit cost $219 million to build, and the sate requires $940,000 worth of grading before it is suatable for construction. What is the proper cosh flow amount to use as the inhal irvestment in fored assets when evaluating this project? Note: Do not round intermediote colculations and enter your antwer in dollars, not millions, rounded to the nearest whole number. - 0. 1,234,567. Parker \& Stone, incorporated, is looking at setting up a new manufacturing plant in South Park to produce garden qools. The company bought some land six years apo for $79 milion in anticipation of using it as a warehcurse and tistrbution site, but the company has since decided to rent facilies elsewhere. If the land were sold today, the company would net $107 million. The company now wants to build its new manufactiaing plant on this land, the plant wit cost $219 million to build, and the sate requires $940,000 worth of grading before it is suatable for construction. What is the proper cosh flow amount to use as the inhal irvestment in fored assets when evaluating this project? Note: Do not round intermediote colculations and enter your antwer in dollars, not millions, rounded to the nearest whole number. - 0. 1,234,567

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts